- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

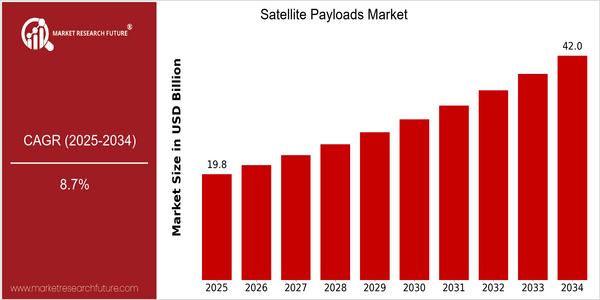

Satellite Payloads Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 19.83 Billion |

| 2034 | USD 42.0124058975349 Billion |

| CAGR (2025-2034) | 8.7 % |

Note – Market size depicts the revenue generated over the financial year

The satellite payloads market is expected to grow significantly, from a value of $ 19.83 billion in 2025 to $ 42.01 billion in 2034. This is a robust CAGR of 8.7% over the forecast period. The growing demand for advanced satellites for telecommunications, earth observation and scientific research is the main reason for this growth. The more satellites there are, the more they need to be equipped with sophisticated payloads that can transmit and record data in new and more powerful ways. The miniaturization of satellite components and the development of small satellite constellations are also driving market growth. SpaceX, Boeing and Northrop Grumman are at the forefront of these developments, making strategic investments and forming strategic alliances to enhance their payload offerings. SpaceX's Starlink project, for example, is a good example of the integration of payloads in satellites and the opportunity that it represents for the market. The interplay between technological innovation and strategic initiatives will continue to shape the satellite payloads market.

Regional Deep Dive

The payload market is growing rapidly all over the world, driven by the growing demand for satellite communication, the rise of small satellites and the increasing number of satellite launches. In North America, the market is characterized by the strong presence of key players and government initiatives to enhance satellite capabilities. Europe is characterized by a boom in collaborative projects and regulatory support for satellite innovation. Asia-Pacific is experiencing strong growth, with increasing investment in space technology and satellite systems. The Middle East and Africa are primarily focused on the development of satellite systems for telecommunications and broadcasting. Latin America uses satellite technology for various applications, including agriculture and disaster management.

North America

- In the United States, the National Defense Authorization Act, which places great emphasis on the importance of payloads to the national defense, has favored the development of satellites.

- SpaceX and Northrop Grumman are at the forefront of satellite payload technology. SpaceX's Starlink project will revolutionize the way we get the Internet through satellite constellations.

- The FCC has enacted new regulations that will speed the process of granting licenses to satellite operators, encouraging more of them to enter the field and thereby increasing competition.

Europe

- The European Space Agency has launched the Copernicus programme, which aims to observe the earth from space and to monitor the environment. This has created a demand for advanced instruments which can be used in such operations.

- Horizon 2020 and other joint projects have been working to develop satellite payloads that will support the mitigation of climate change and the sustainable use of natural resources.

- Europe is becoming more supportive of satellite launches. Initiatives to reduce bureaucratic barriers and to promote public-private collaborations are being taken.

Asia-Pacific

- India and China have already launched a number of satellites with advanced payloads, for communication and earth observation.

- The emergence of private space companies in the region, such as OneWeb and Planet Labs, has prompted innovation and competition in the development of payloads.

- Japan and South Korea have launched projects to develop satellites for disaster prevention and communications, as a result of their unique problems.

MEA

- The Mohammed bin Rashid Space Centre is currently working on developing satellite payloads for a number of purposes, including the KhalifaSat, which will contribute to the development of the region's capabilities in earth observation.

- Saudi Arabia's Vision 2030 plan includes a significant investment in the field of satellites for telecommunications and broadcasting, which reflects the strategic importance of the country's national communication network.

- Regulatory bodies in the region are increasingly recognizing the importance of satellite technology and establishing regulatory frameworks that support satellite launches and operations.

Latin America

- Brazil's National Institute of Space Research (INPE) is utilizing payloads for the purpose of securing the environment and managing natural disasters, thus highlighting the region's interest in conservation.

- Small-satellite enterprises in countries like Chile and Argentina are fostering innovation and enabling new payload applications for agriculture and telecommunications.

- A change of regulations in countries like Mexico is intended to encourage the development of satellite technology and foreign investment in space.

Did You Know?

“By the end of the year 2025 it is expected that 60 per cent of the world's population will be able to use the satellites for Internet access, thanks to the development of satellite payloads and the proliferation of low-Earth orbit satellites.” — International Telecommunication Union (ITU)

Segmental Market Size

The payload market is an important branch of the satellite industry, which is growing steadily, and is mainly based on the demand for more advanced communication, Earth observation and scientific research applications. The payload market is driven by the increasing demand for high-capacity communications, especially in remote areas, and the increasing importance of monitoring climate and natural hazards, which in turn require more sophisticated payloads.

Currently the market is in a phase of large-scale implementation, with SpaceX and Airbus leading the way in terms of payload solutions. The main applications are LEO (Low Earth Orbit) based internet and high-resolution earth observation. Further growth is driven by government initiatives to promote satellite services and by the push towards sustainable development. Miniaturized payloads and advanced sensors are shaping the future of this field. They make for more efficient and versatile satellite operations.

Future Outlook

From 2025 to 2034, the payload market will grow from $19.83 billion to approximately $42 billion, with a CAGR of 8.7 percent. The main reason for this growth is the increasing demand for advanced satellite communication, earth observation and scientific applications. Meanwhile, with the increased investment in satellite technology by governments and private companies, the payload market will continue to evolve with an increase in data processing capabilities, miniaturization, and the use of artificial intelligence for real-time data analysis. The penetration of high-capacity payloads will reach more than 60 percent in 2034, driven by the proliferation of low-Earth-orbit satellite constellations and the increasing demand for global communication.

The development of multi-functional payloads and the use of new materials will also stimulate the market. Government support for space exploration and satellite deployment will also stimulate the market. Also, the emergence of commercial space and the increasing focus on the sustainable use of satellites will change the competitive landscape. In this evolving market, the participants must remain flexible and adapt to the rapid pace of innovation and the changing demands of the consumers in order to seize the opportunities that the market offers.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 8.70% (2023-2030) |

Satellite Payloads Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.