Growing Demand for Niche Content

The internet radio market in Russia is witnessing a growing demand for niche content, which is reshaping the broadcasting landscape. Listeners are increasingly seeking specialized programming that caters to specific interests, such as local music genres, cultural discussions, and community news. This trend is reflected in the rise of independent radio stations that focus on unique content, attracting dedicated listener bases. The internet radio market is responding by diversifying its offerings, with niche stations experiencing growth rates of up to 20% annually. This shift not only enhances listener satisfaction but also fosters a sense of community among audiences. As the market continues to evolve, the emphasis on niche content is likely to play a pivotal role in attracting and retaining listeners, thereby driving overall market growth.

Advertising Revenue Opportunities

The internet radio market in Russia is increasingly becoming a lucrative platform for advertisers, presenting substantial revenue opportunities. With the audience for internet radio expanding, advertisers are recognizing the potential to reach targeted demographics effectively. The market is projected to see advertising revenues grow by approximately 25% over the next three years, driven by the ability to deliver personalized ads based on listener preferences. This targeted approach not only enhances the effectiveness of advertising campaigns but also provides a more engaging experience for listeners. As brands seek to capitalize on the growing audience, the internet radio market is likely to become a key player in the advertising landscape, further solidifying its position as a viable medium for marketing.

Increased Mobile Device Penetration

The rise in mobile device penetration in Russia is significantly impacting the internet radio market. With over 70% of the population owning smartphones, the accessibility of internet radio has dramatically improved. Mobile applications dedicated to streaming radio content are becoming increasingly popular, allowing users to listen on-the-go. This trend is particularly pronounced among younger demographics, who prefer mobile platforms for their media consumption. The internet radio market is capitalizing on this shift, as mobile listening accounts for nearly 60% of total internet radio consumption. As mobile technology continues to evolve, it is expected that the market will further expand, potentially reaching a user base of over 30 million by 2026. This driver underscores the importance of mobile accessibility in shaping the future of the internet radio landscape.

Regulatory Support for Digital Media

The internet radio market in Russia is benefiting from increasing regulatory support for digital media. Government initiatives aimed at promoting digital content and enhancing media diversity are creating a favorable environment for internet radio stations. Recent policies have encouraged the establishment of new broadcasting platforms, leading to a surge in the number of internet radio stations. This regulatory support is crucial for the market, as it fosters innovation and competition among broadcasters. As a result, the internet radio market is expected to grow steadily, with an anticipated increase in the number of licensed stations by 30% over the next five years. This supportive regulatory framework not only enhances the market's credibility but also encourages investment in new technologies and content development.

Technological Advancements in Broadcasting

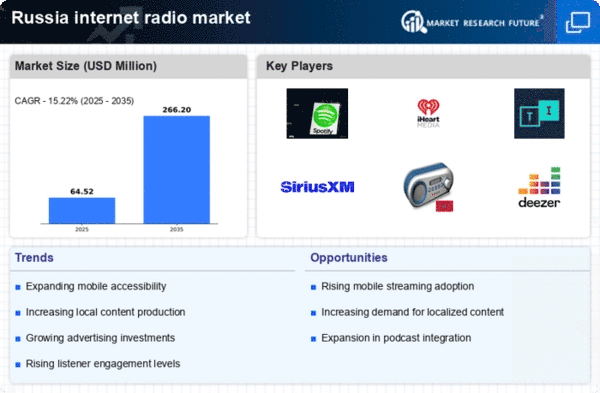

The internet radio market in Russia is experiencing a notable transformation due to rapid technological advancements in broadcasting. Innovations such as improved streaming protocols and enhanced audio quality are making internet radio more appealing to listeners. The proliferation of high-speed internet access, with over 80% of urban households connected, facilitates seamless streaming experiences. Furthermore, the integration of artificial intelligence in content curation is personalizing user experiences, thereby increasing listener engagement. As a result, the internet radio market is likely to see a surge in user adoption, with projections indicating a growth rate of approximately 15% annually over the next five years. This technological evolution not only enhances the quality of broadcasts but also expands the potential audience base, making it a critical driver for the market.