Russia Graphene Market Summary

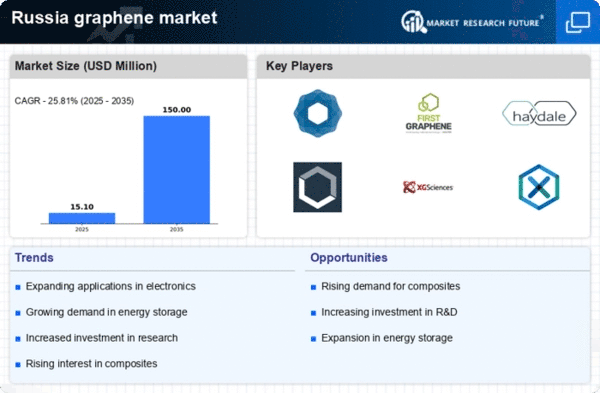

As per Market Research Future analysis, the Russia graphene market Size was estimated at 12.0 USD Million in 2024. The Russia graphene market is projected to grow from 15.1 USD Million in 2025 to 150.0 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 25.8% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Russia graphene market is poised for growth driven by technological advancements and increasing applications across various sectors.

- The electronics segment represents the largest market share, reflecting a robust demand for graphene-based components.

- Energy storage applications are emerging as the fastest-growing segment, indicating a shift towards innovative energy solutions.

- Government support for research is fostering advancements in graphene technologies, enhancing market potential.

- Technological innovations in manufacturing and rising demand for sustainable solutions are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 12.0 (USD Million) |

| 2035 Market Size | 150.0 (USD Million) |

| CAGR (2025 - 2035) | 25.81% |

Major Players

Graphenea (ES), First Graphene (AU), Haydale Graphene Industries (GB), Applied Graphene Materials (GB), XG Sciences (US), NanoXplore (CA), Directa Plus (IT), Graphene Flagship (EU)