Rumination Syndrome Size

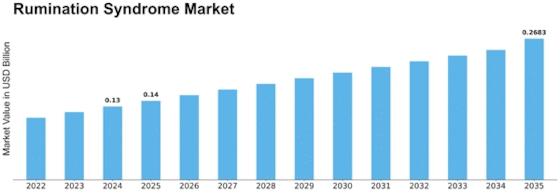

Rumination Syndrome Market Growth Projections and Opportunities

The Rumination Syndrome market is a unique gastrointestinal ailment where food is forced to be regurgitated after eating. The act of rumination involves the effortless and rhythmic evacuation of undigested food material from the stomach into the mouth where an individual either re-chews it and swallows or spits it out again. The market for Rumination Syndrome has been interested in understanding, diagnosing and controlling this disorder to effectively improve its victims’ lifestyles despite being rare and thus having serious implications on physical as well as mental health.

Medical practitioners in the Rumination Syndrome market aim at sensitizing people on proper diagnostic approaches and effective interventions which will help raise awareness about this condition among individuals. Symptoms of rumination syndrome are; regurgitation, no weight gain, change in eating habits, dental problems among others. As part of any examination of ruminationsyndrome modern technologies like esophageal motility studies and pH monitoring that enable its identification are worth considering.

Although nutritional advice should be provided because malnutrition ensues, available treatment options for Rumination Syndrome only cover physiological aspects whereas psychological ones still need to be attended gestalt therapy biofeedback diaphragmatic breathing exercise etc are employed in breaking this vicious cycle. Malnutrition also calls for nutritional counseling. Other interventions may include acid suppressants meant to manage other concurrent problems. It is a dynamic industry with new therapies being studied further on overall management can be improved.

There is also an integrated approach towards handling patients suffering from rumination syndrome since gastroenterologists, psychologists and dietitians work together withinthe industry thus helping them deal with emotional challenges developing from stressors.Given that they provide room for interaction among individuals facing similar situations involving their medical conditions support groups plus patient advocacy organizations play an important role in facilitating information sharing resources access campaigning for increased visibility plus awareness regarding rumination syndrome.

Leave a Comment