- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Covered Aspects:

| Report Attribute/Metric | Details |

|---|---|

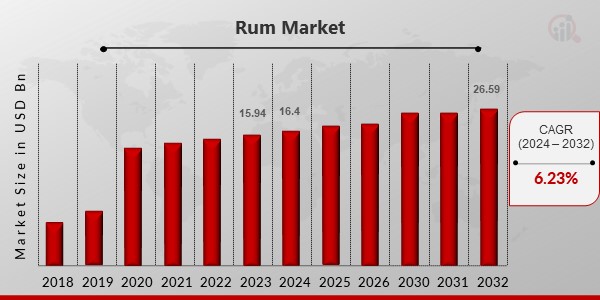

| Market Size Value In 2023 | USD 16.4 Billion |

| Growth Rate | 6.40% (2023-2030) |

Rum Market Highlights:

Global Rum Market Overview

Rum Market Size was valued at USD 15.94 billion in 2023. The rum industry is projected to grow from USD 16.4 Billion in 2024 to USD 26.59 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.23% during the forecast period (2024 - 2032). Millennials' preference for rum over other alcoholic beverages, as well as rising demand for premium varieties of rum are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Rum Market Trends

-

Growing demand for patented flavour to boost market growth

As the urban population has grown and disposable income in emerging economies has increased, people have begun to explore new forms of entertainment, including hanging out at nightclubs, bars, pubs, and lounges. With easy access to energy consumption, the effect on social media, and alcoholic beverages, it is a significant factor in boosting sales of alcoholic beverages by young people. A major factor boosting growth in the rum market will be patented flavour and rising flavour demand. The amount of money made by the rum market is significantly impacted by consumers' extreme preference for online retailers. Income is a key factor in determining sales of alcoholic beverages because it affects consumers' ability to make purchases. The number of middle-class consumers has grown recently, according to the United Nations. As disposable income for food and beverages rises, consumers in this category are more likely to lead better lives.

Additionally, the rising demand for premium rums will play a significant role in propelling the expansion of the world rum market. As per capita income rises in developed and developing nations, there is an increase in consumer demand for premium rum. Rum of a higher calibre is distinguished by its authenticity, flavour, and brand. The market is flooded with different suppliers who offer a wide selection of rums to satisfy the growing demand for rum of exceptional quality and flavour. The willingness of consumers to spend more on premium quality rum will encourage market CAGR during the anticipated time frame.

Due to their authenticity, flavour, and brand, premium rum varieties are becoming more and more popular. Additionally, the increased per capita income of consumers in developed and developing nations has significantly increased consumer preferences for premium rums. Thus it led to the expansion of rum market revenue.

Rum Market Segment Insights

Rum Market Type Insights

The rum market segmentation, based on type, includes white and dark. The dark rum segment contributed more than 45% of revenue. Several aged rums are classified as dark; these have a stronger flavor and are typically consumed neat or with ice. Because of its smooth flavor, aged dark rum is in high demand among millennials. It is aged in oak barrels and gives cocktails more depth. By continuously investing in its Ocho, Cuatro, and Diez portfolios, Bacardi Ltd has been focusing on the premiumization of rum/dark spirits.

Figure 1: Rum Market, by Type, 2022& 2030 (USD billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Rum Market Category Insights

The rum market segmentation, based on category, includes standard and over proof. In the near future, the standard rum segment is expected to dominate the rum market.

Rum Market Distribution Channel Insights

The rum market data has been bifurcated by distribution channel into hypermarkets and supermarkets, specialty stores and others. In 2022, the offline trading segment had a revenue share of over 75% in the market, and over the forecast period, it is anticipated to grow rapidly. The segment is anticipated to gain a significant market share in the years to come thanks to reasons such as easy access to spirits at supermarkets/hypermarkets, liquor stores, and specialty shops as well as increased customer willingness to purchase via these channels. The segment's growth will also be aided by the introduction of new products at supermarkets and hypermarkets by a number of market participants.

Rum Market Regional Insights

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. Asia Pacific accounted for over 40% of revenue in 2022 and is expected to grow at a significant rate from 2022 to 2028, owing to the presence of a large population, rise in disposable income, and increasing popularity of rum among the younger generation. Countries such as India and the Philippines, which are major producers and consumers, contribute significantly to this growth. According to the company, by 2022, Bacardi's business in India will have grown by 30%, making it one of its fastest-growing markets.

Further, the major countries studied in the market report are: The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: RUM MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe rum market accounts for the second-largest market share, demand for rum among younger consumers, combined with a focus on targeted marketing and product innovation, is driving high-end spirits sales in countries such as the United Kingdom and France. Further, the German rum market held the largest market share, and the UK rum market was the fastest growing market in the European region.

The North America rum market is expected to be the fastest-growing rum market from 2022 to 2028. The presence of a large number of producers, rising demand for premium rums, and an increase in the consumption of flavored and spiced rums in cocktails are factors driving market growth. Moreover, China rum market held the largest market share, and the India rum market was the fastest growing market in the Asia-Pacific region.

Rum Market Key Market Players & Competitive Insights

Leading industry players are investing a lot of money in R&D to expand their product offerings, which will spur further market growth for rum. With significant industry changes like new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market participants are also undertaking a variety of strategic activities to expand their presence. To grow and thrive in a market that is becoming more competitive and growing, competitors in the rum market industry must provide products that are affordable.

Manufacturing locally to cut operating costs is one of the main business methods used by manufacturers in the rum industry to benefit customers and increase the market sector. The rum market industry has recently given medicine some of the most important advantages. Major players in the rum industry, including Bacardi Limited in Bermuda, Gruppo Campari in Italy, Mohan Makin in India, Matusalem in the Dominican Republic, and The Edrington Group in the United Kingdom, are seeking to increase market demand by funding R&D initiatives.

Hilton Head Island, sometimes known as Hilton Head, is a barrier island and Low country resort community in Beaufort County, South Carolina, in the United States. It is 95 miles (153 kilometers) southwest of Charleston and 20 miles (32 km) northeast of Savannah, Georgia. Captain William Hilton discovered a promontory near the entrance to Port Royal Sound in 1663, and cartographers gave it the name "Hilton's Headland" as a result. The island has 12 miles (19 km) of Atlantic Ocean shoreline and is a well-liked holiday spot. In August 2022, the launch of Panela and Solera Rum products at the distillery and retail sites throughout South Carolina was announced by Hilton Head Distillery. It announced the release of each distinct copper pot-distilled rum in small batches.

Bacardi Limited is one of the world's largest privately held, family-owned spirits companies. Originally known for its white rum brand, Bacardi, it now has a portfolio of over 200 brands and labels. Bacardi Limited, founded in Cuba in 1862 and family-owned for seven generations, employs over 8,000 people and sells in approximately 170 countries. Bacardi Limited refers to the entire group of companies, which includes Bacardi International Limited. In March 2022:Bacardi India, the largest spirits company in the world and the rum market leader, announced the debut of Good Man, a brandy and Indian Made Foreign Liquor (IMFL) category entry. Good Man was created exclusively for the Indian market. The producer of Grey Goose vodka and Bacardi rum projects a fivefold increase in income by 2030.

Key Companies in the rum market includes

- Diageo PLC (UK)

- Pernod Ricard SA (France)

- Beam Suntory Inc. (US)

- Bacardi Limited (Bermuda)

- Gruppo Campari (Italy)

- Mohan Meakin (India)

- Matusalem (Dominican Republic)

- The Edrington Group (UK)

- Corporacion Cuba Ron (Cuba)

- Pusser's Rum Ltd. (US) among others

Rum Market Industry Developments

In February 2022: Casalu, a rum-based hard seltzer, is scheduled to debut later this month in Miami with the goal of fostering a sense of ancestry and belonging while enabling individuals to enjoy Hispanic culture. aged dark rum, 5.9% vol. "Limón," Casalu's debut release, is clean and well-balanced with just the right amount of buzz. It gives the hard seltzer market a true Latino flavour. The business and its founders are based in the United States, and they are assisted by a group of seasoned professionals from the beverage and entertainment industries.

In April 2022, A variety of rums from the French discipline and the tropical passion of centuries-old Indian workmanship were presented by the French artisanal rum firm "Plantation." The two Plantation Rum contenders, 3 Stars and Original Dark, were introduced in Mumbai and Goa, respectively. Third Eye Distillery (TED), the parent firm of Stranger and Sons, will serve as the official partner for the brand in India.

In July 2022, the Bush Rum Co., a United Kingdom-owned company, launched its sustainable drink in India through a local partner, Mumbai-based Monika Alcobev Limited. In addition, the company has introduced brands such as Jose Cuervo, Templeton Rye whisky, and Rutini wines to the country.

Rum Market Segmentation

Rum Market By Type Outlook

- White

- Dark

Rum Market By category Outlook

- Standard

- Over proof

Rum Market By Distribution Channel Outlook

- Hypermarkets and Supermarkets

- Specialty Stores

- Others

Rum Market Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America