Rubber Vulcanization Size

Rubber Vulcanization Market Growth Projections and Opportunities

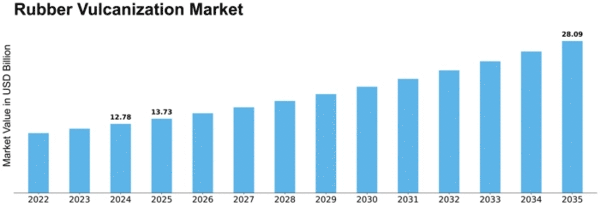

The global rubber vulcanization market is predicted to grow from USD 7.82 billion in 2017 to USD 11.22 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.94%. In terms of volume, the market is expected to increase from 2,744.7 KT in 2017 to 3,766.5 KT by 2025, at a CAGR of 4.36%. This growth is mainly driven by the high demand for rubber in tire production for the automotive & transportation industry, fueled by increased automobile production and sales globally. For instance, in 2017, a total of 97,302,534 vehicles were manufactured. Another contributing factor is the rising use of silicone and natural rubbers in the healthcare sector for various applications, such as injection parts, gloves, rollers, tubes, mammary prostheses, and pacemaker leads. Additionally, the increasing use of rubber in consumer goods like footwear and sports shoes, as well as industrial applications including fuel hoses, conveyor belts, and printing rollers, is expected to contribute to market growth. The oil & gas industry's growing use of rubber products is also creating opportunities for market players. The market is witnessing a megatrend with the introduction and gradual adoption of devulcanization technology, allowing devulcanized rubber to be re-vulcanized and reused like virgin rubber.

According to analysis, the market is categorized by type, technique, end-use industry, and region. The types of vulcanization agents include sulfur, tellurium, selenium, metallic oxides, and others. Accelerators, a major segment, includes subcategories like dithiocarbamate, dithiophosphate, sulfenamides, xanthates, and others. The sulfur vulcanization technique dominates the market. End-use industries driving market consumption include automotive & transportation, industrial, consumer goods, healthcare, and others. Automotive & transportation is the largest consumer and is expected to witness significant growth. The Asia-Pacific region, especially ASEAN countries, contributes significantly to the market's fastest-growing region, with China, Japan, and India being major contributors due to high rubber production and low-cost labor. China, with 29,015,434 units produced, has the highest automobile production globally.

Leave a Comment