Roofing Adhesives Size

Roofing Adhesives Market Growth Projections and Opportunities

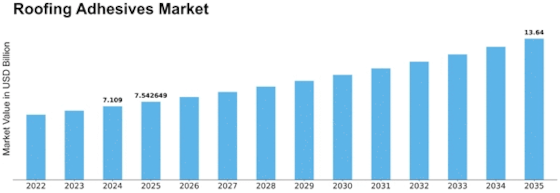

Market factors shape the Roofing Adhesives Market. Growth in the development business drives this market. As urbanization and industry spread, roofing adhesive demand has increased. Building residential, business, and modern structures demands tough roofing, creating a strong roofing adhesives industry. Roofing Adhesives is expected to grow from USD 6.7 Billion in 2023 to USD 10.7 Billion in 2032, a CAGR of 6.10%.

Mechanical advances have also impacted roofing adhesives. Superior adhesives with improved holding and toughness have been developed due to cement definition and assembly process improvements. This has expanded the use of roofing adhesives and attracted more customers seeking more efficient and affordable roofing solutions.

Natural considerations also shape the roofing adhesives market. Low-VOC, eco-friendly adhesives are becoming more popular as manageability and eco-friendliness become more important. Producers are responding by making adhesives that meet strict natural standards for environmentally conscious customers and administrative needs.

The roofing adhesives market is heavily influenced by finance. Loan fees and financial reserves might hinder development projects. During financial downturns, development projects may be delayed or canceled, affecting roofing adhesive demand. During economic growth, expanded development activities boost roofing adhesives' popularity.

Globalization has increased roofing adhesives competition. Makers compete with domestic and international players through global exchange. This approach urges companies to focus on product separation, development, and cost-viability to gain market share.

Administrative considerations also deeply affect roofing adhesives. Legislation and regulations ensure the safety, quality, and natural effect of development materials, including adhesives. These concepts are crucial for market operators to build confidence with buyers and meet legal requirements.

Buyer preferences and habits also effect roofing adhesives sales. Roof adhesives that support energy-efficient and sustainable construction practices become more popular as shoppers become more aware of them. Following this trend, manufacturers are offering adhesives that improve energy efficiency and structure maintenance.

Leave a Comment