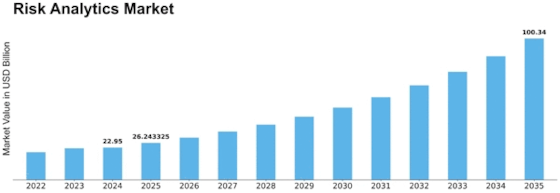

Risk Analytics Size

Risk Analytics Market Growth Projections and Opportunities

The Risk Analytics market is shaped with the aid of numerous market factors that collectively have an impact on its dynamics and increased trajectory. One of the number one factors driving the growth of the Risk Analytics market is the growing complexity and variety of dangers confronted by corporations. As groups operate in an environment characterized by globalization, digitalization, and interconnected delivery chains, the spectrum of risks has accelerated to include monetary, operational, cybersecurity, and compliance risks. The demand for comprehensive Risk Analytics solutions arises from the need to determine, display, and mitigate these multifaceted dangers successfully. Regulatory compliance is a pivotal market element in the Risk Analytics panorama. The continuously evolving regulatory landscape, marked by the use of stringent facts, safety laws, and industry-unique compliance necessities, drives agencies to undertake superior technological solutions to ensure adherence to policies. The integration of advanced technologies, including artificial intelligence (AI) and machine learning (ML), is a giant market element shaping the risk analytics landscape. Organizations are increasingly leveraging AI and ML algorithms to decorate their threat evaluation and predictive capabilities. The proliferation of large facts is a key market component influencing the Risk Analytics landscape. Organizations grapple with sizable datasets originating from inner and external sources, including transactional statistics, social media, and cybersecurity logs. The dynamic of dealing with and extracting meaningful insights from this records deluge necessitates sophisticated analytics gear capable of processing and analyzing massive datasets correctly. The adoption of big records analytics in Risk Analytics displays a market thing centered on harnessing the strength of data to make informed threat management choices and derive actionable insights. Operational resilience is rising as an essential market element within risk analytics. Organizations recognize the significance of making sure commercial enterprise operations are uninterrupted in the face of numerous disruptions, together with herbal disasters, deliver chain disruptions, and international crises. Risk Analytics answers that verify and beautify operational resilience have come to be critical for groups searching to pick out vulnerabilities, broaden contingency plans, and build sturdy chance control techniques. Competitive pressures and enterprise collaboration are dynamic elements influencing the Risk Analytics market. With several companies offering numerous solutions, opposition fosters innovation as groups try to differentiate themselves through functions, performance enhancements, and unique value propositions. Collaborations and partnerships between Risk Analytics companies and enterprise-particular players contribute to the dynamic growth of the market. The synergies created through collaboration allow agencies to get the right of entry to complete threat control solutions that deal with industry-specific challenges and regulatory nuances.

Leave a Comment