Government Policies and Incentives

Government policies play a crucial role in shaping the Right-hand Drive Electric Vehicle Market. Various countries are implementing incentives such as tax rebates, grants, and subsidies to encourage the adoption of electric vehicles. For instance, some regions have introduced zero-emission vehicle mandates, which require a certain percentage of new vehicle sales to be electric. These initiatives are designed to reduce carbon emissions and promote sustainable transportation. As a result, the market is likely to witness a significant uptick in electric vehicle registrations, with projections indicating that by 2030, electric vehicles could account for nearly 30% of total vehicle sales in certain markets. Such supportive regulatory frameworks are essential for fostering growth in the electric vehicle sector.

Rising Fuel Prices and Economic Factors

The Right-hand Drive Electric Vehicle Market is also influenced by rising fuel prices and economic factors. As traditional fuel costs continue to escalate, consumers are increasingly seeking alternatives that offer long-term savings. Electric vehicles, with their lower operating costs and reduced maintenance requirements, present a financially viable option for many drivers. Additionally, the economic shift towards greener technologies is prompting consumers to consider electric vehicles as a practical investment. Market analysis indicates that the total cost of ownership for electric vehicles is becoming more favorable compared to internal combustion engine vehicles, further driving demand. This trend is expected to continue, potentially leading to a substantial increase in electric vehicle adoption across various demographics.

Technological Innovations in Electric Vehicles

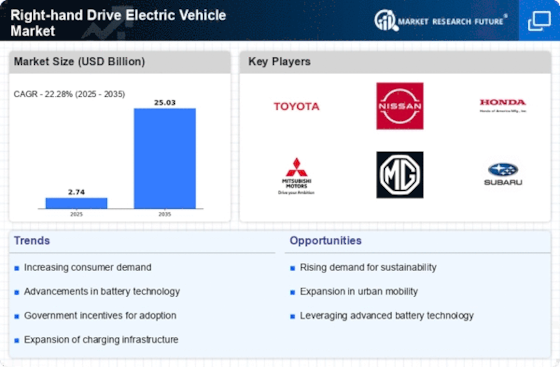

The Right-hand Drive Electric Vehicle Market is experiencing a surge in technological innovations, particularly in battery efficiency and electric drivetrains. Advancements in solid-state batteries are expected to enhance energy density and reduce charging times, making electric vehicles more appealing to consumers. Furthermore, the integration of smart technologies, such as autonomous driving features and connected vehicle systems, is likely to attract a broader customer base. As manufacturers invest in research and development, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This technological evolution not only improves vehicle performance but also aligns with the increasing demand for eco-friendly transportation solutions.

Infrastructure Development for Electric Vehicles

Infrastructure development is a pivotal driver for the Right-hand Drive Electric Vehicle Market. The expansion of charging networks is essential for alleviating range anxiety among potential electric vehicle buyers. Governments and private entities are investing in the establishment of fast-charging stations and home charging solutions, which are crucial for supporting the growing number of electric vehicles on the road. Recent data indicates that the number of public charging stations has increased significantly, with some regions reporting growth rates exceeding 30% annually. This enhanced infrastructure not only facilitates the adoption of electric vehicles but also encourages manufacturers to invest in the market. As charging solutions become more accessible, the likelihood of increased electric vehicle sales rises, further propelling market growth.

Environmental Awareness and Sustainability Trends

The Right-hand Drive Electric Vehicle Market is significantly impacted by growing environmental awareness and sustainability trends. Consumers are becoming more conscious of their carbon footprints and are actively seeking ways to reduce their environmental impact. This shift in consumer behavior is driving demand for electric vehicles, which are perceived as a cleaner alternative to traditional vehicles. Market Research Future suggests that a considerable percentage of consumers are willing to pay a premium for electric vehicles that align with their values of sustainability. As awareness of climate change and pollution intensifies, the market for electric vehicles is likely to expand, with projections indicating a potential doubling of market size within the next decade. This trend underscores the importance of aligning product offerings with consumer values.