Resistance Bands Size

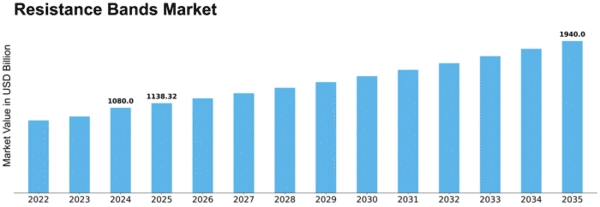

Resistance Bands Market Growth Projections and Opportunities

Few factors shape resistance bands market, and these elements influence its trends and growth within the fitness and wellness sectors. One major factor is the growing focus on home-based and multi-function fitness activities. Resistance bands, known for their portability and adaptability in various exercises are a popular option among fitness enthusiasts if they are looking to engage in effective strength training outside traditional gym settings. The drive for easy-to-use and compact fitness machines seeds the steady growth of resistance bands market to accommodate people who are interested in their workouts being adaptable. Demographics are important factors that influence the market for resistance bands. Customer preferences for resistance bands are determined by age, physical fitness level and lifestyle. Brands are able to meet and cater to the demographics of fitness enthusiasts by offering a range in resistance band strengths, styles and price points that allows different consumer segments resonate with them thus ensuring brand relevance on the marketplace as well sustaining customer interest over time. The resistance bands market is based on economic factors such as disposable incomes and consumers’ expenditure towards fitness and wellness products. Economic stability and growing disposable income requires more spending in non-essential domains, such as home fitness equipment. When the economy grows, consumers are likely to invest in high-end or specialised resistance bands. On the other hand, consumer purchases of recreational goods may be influenced by economic contractions that can affect resistance bands sales. Brand image and marketing strategies are important aspects that shape consumer perceptions in the resistance bands market. Brand loyalty is usually strong for the reputable established fitness equipment brands and those known to produce high-quality, durable, user-friendly products. Brand visibility is enhanced by effective marketing campaigns that promote features such as durability, versatility and resistance levels in the competitive market for Resistance bands. Growth of the market is also due to developments in technology regarding resistance band design and materials. The advanced functions include anti-snap technology, fabric bands, and multi-resistance levels that improve the effectiveness of resistance band activities as well as make them user friendly. Technological advancements also influence how resistance bands look with a wide variety of designs and colors that offer what appeals to today’s consumers.

Leave a Comment