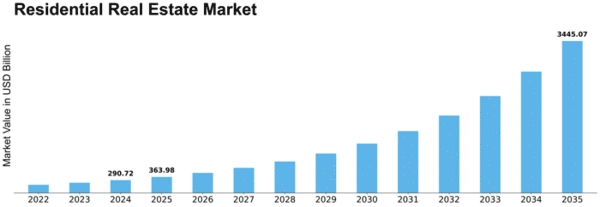

Residential Real Estate Size

Residential Real Estate Market Growth Projections and Opportunities

The Residential Real Estate Market is influenced by a multitude of factors that collectively shape its growth and dynamics. A key driver is the demographic composition of the population, including factors such as population growth, household formation, and generational trends. As the population expands and new households are formed, the demand for residential properties increases. Additionally, generational shifts, such as millennials entering the housing market, influence preferences and trends, impacting the types of properties sought and the locations favored for residential real estate.

Economic conditions play a pivotal role in shaping the Residential Real Estate Market. Factors such as employment rates, income levels, and interest rates influence the purchasing power of potential homebuyers. Favorable economic conditions, low unemployment, and competitive mortgage rates contribute to a robust real estate market. Conversely, economic downturns, job uncertainties, and high-interest rates can dampen demand and affect property values. The residential real estate market is closely linked to the overall economic health of a region or country.

Government policies, regulations, and fiscal measures significantly impact the Residential Real Estate Market. Policies related to mortgage lending, tax incentives, and zoning regulations influence the affordability and accessibility of residential properties. Government interventions, such as first-time homebuyer programs or tax credits, can stimulate demand. On the other hand, regulatory changes, zoning restrictions, or alterations in property tax structures can affect property values and market dynamics. The real estate market is responsive to the legal and regulatory framework within which it operates.

Consumer sentiment and perception of the real estate market influence buying decisions. Market perceptions, influenced by media coverage, economic forecasts, and public sentiment, play a role in shaping demand. Positive perceptions of market stability, potential for property appreciation, and a conducive economic environment can boost buyer confidence. Negative sentiments, such as concerns about economic downturns or market uncertainties, may lead to cautious buying behavior. The psychological aspect of real estate decision-making contributes to the cyclical nature of the market.

Supply and demand dynamics are critical factors in the Residential Real Estate Market. The availability of housing inventory, construction activity, and the balance between supply and demand influence property values and market conditions. Shortages in housing supply relative to demand can lead to increased competition among buyers, driving up prices. Conversely, oversupply can result in price corrections and impact the overall health of the market. The interplay between supply and demand is a key determinant of market trends and property values.

Market competition and industry collaborations shape the Residential Real Estate Market. The market includes real estate agents, developers, mortgage lenders, and other stakeholders who collaborate to facilitate property transactions. Innovations in real estate technology, collaborative platforms, and marketing strategies contribute to the competitiveness of the industry. Partnerships within the real estate ecosystem, such as collaborations between developers and financial institutions, drive the development of residential projects and financing options, influencing market trends.

Cultural and lifestyle trends impact the Residential Real Estate Market. Changing preferences related to urbanization, sustainability, and lifestyle choices influence the demand for specific types of properties. Trends such as the preference for eco-friendly homes, smart home technology, and walkable neighborhoods shape the development and marketing of residential real estate. The industry adapts to these evolving trends to meet the diverse demands of homebuyers.

Challenges related to affordability, housing shortages, and market speculation are factors that the residential real estate industry addresses. Affordability concerns arise as property values increase faster than income levels, limiting access to homeownership. Housing shortages, particularly in high-demand areas, contribute to competitive markets and rising prices. Market speculation, driven by investor activity or speculative buying, can lead to price volatility and impact the stability of the real estate market. The industry works on addressing these challenges through initiatives such as affordable housing programs, urban planning strategies, and regulatory measures.

Leave a Comment