Increased Cyber Threats

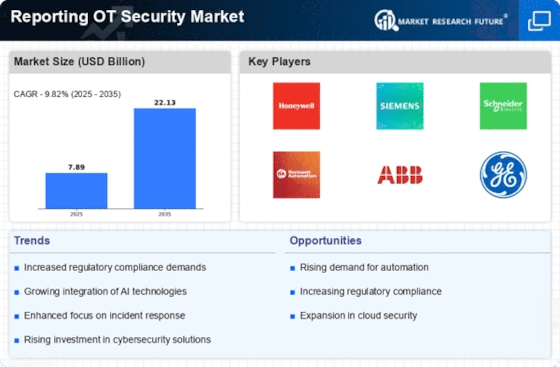

The rise in cyber threats targeting operational technology (OT) systems has become a critical driver for the Reporting OT Security Market. As industries increasingly rely on interconnected devices and systems, the vulnerability to cyberattacks has escalated. Reports indicate that the number of cyber incidents affecting OT environments has surged, prompting organizations to prioritize security measures. This heightened awareness of potential risks has led to a growing demand for reporting solutions that can provide real-time insights into security postures. Consequently, the Reporting OT Security Market is witnessing a significant uptick in investments aimed at enhancing threat detection and response capabilities.

Adoption of Advanced Analytics

The adoption of advanced analytics technologies is emerging as a key driver in the Reporting OT Security Market. Organizations are increasingly leveraging data analytics to gain deeper insights into their security postures and identify potential vulnerabilities. By utilizing machine learning and artificial intelligence, companies can enhance their reporting capabilities, enabling proactive threat detection and response. This trend is evident in the market, where the integration of advanced analytics into reporting solutions is becoming a standard practice. As organizations strive for greater efficiency and effectiveness in their security measures, the demand for analytics-driven reporting tools is likely to escalate, further fueling growth in the Reporting OT Security Market.

Integration of IT and OT Security

The convergence of information technology (IT) and operational technology (OT) security is reshaping the landscape of the Reporting OT Security Market. As organizations seek to streamline operations and enhance efficiency, the integration of IT and OT systems has become commonplace. This integration, however, introduces new security challenges that necessitate comprehensive reporting solutions. Organizations are now looking for tools that can provide a unified view of security across both domains. The demand for integrated reporting solutions is expected to grow, as businesses recognize the importance of holistic security strategies that encompass both IT and OT environments, thereby propelling the Reporting OT Security Market forward.

Regulatory Compliance Requirements

Regulatory compliance is a pivotal factor influencing the Reporting OT Security Market. Organizations are compelled to adhere to stringent regulations that govern data protection and cybersecurity practices. Compliance frameworks, such as the NIST Cybersecurity Framework and ISO 27001, necessitate robust reporting mechanisms to ensure transparency and accountability. As regulatory bodies intensify their scrutiny of OT environments, companies are increasingly investing in reporting solutions that facilitate compliance. This trend is reflected in the market, where the demand for reporting tools that align with regulatory standards is on the rise, thereby driving growth in the Reporting OT Security Market.

Growing Awareness of Operational Risks

The growing awareness of operational risks associated with OT environments is significantly influencing the Reporting OT Security Market. As organizations recognize the potential impact of security breaches on operational continuity, there is an increasing emphasis on risk management strategies. This awareness has led to a heightened demand for reporting solutions that can effectively monitor and assess risks in real-time. Companies are now prioritizing investments in reporting tools that provide comprehensive visibility into their OT security landscape. This trend is indicative of a broader shift towards proactive risk management, which is expected to drive substantial growth in the Reporting OT Security Market.