Top Industry Leaders in the Remote Sensing Satellite Market

Key Players in the Remote Sensing Satellite Market

Antrix Corporation (India)

Geo Sense (Malaysia)

DigitalGlobe (US)

Satellite Imaging Corporation (US)

Mallon Technology (UK)

EKOFASTBA (Spain)

Strategies Adopted by Market Leaders

Market leaders employ diverse strategies to maintain their competitive edge. Airbus, for instance, focuses on innovation and research to introduce cutting-edge satellite technologies. Boeing and Lockheed Martin emphasize strategic partnerships and collaborations, leveraging their expertise in satellite manufacturing and space exploration. Thales, on the other hand, has been investing in the development of compact and cost-effective satellite solutions, targeting emerging markets and cost-conscious customers.

Factors for Market Share Analysis

Analyzing market share in the remote sensing satellite sector involves considering various factors. Technological capabilities, the range and quality of satellite services, global reach, pricing strategies, and customer relationships are crucial elements. Additionally, regulatory compliance, adherence to international standards, and the ability to adapt to evolving market trends play pivotal roles in determining market share.

New and Emerging Companies

The remote sensing satellite market is witnessing the emergence of new players, contributing to increased competition and innovation. Start-ups like Planet Labs, BlackSky Global, and ICEYE are disrupting the market with their small satellite constellations, providing frequent and cost-effective Earth observation services. These companies leverage advancements in miniaturization, propulsion, and data analytics to offer unique solutions for a variety of applications.

Industry News and Developments

Continuous advancements and strategic moves within the industry shape the competitive landscape. In recent news, Planet Labs secured a significant contract with a government agency for its high-frequency satellite imagery services. This emphasizes the growing importance of real-time data for applications such as disaster monitoring and security. Additionally, collaborative projects between government space agencies and private companies highlight the increasing synergy in the remote sensing satellite sector.

Current Company Investment Trends

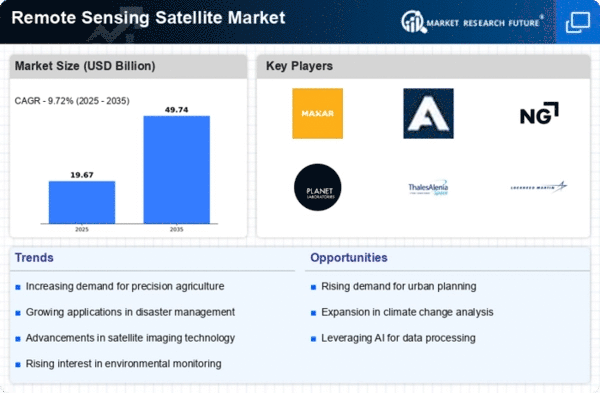

Investment trends in the remote sensing satellite market reflect the industry's growth potential. Companies are allocating resources to research and development, aiming to enhance satellite capabilities, reduce launch costs, and improve data analytics. Venture capital funding is flowing into start-ups focused on niche applications, such as monitoring climate change impacts, precision agriculture, and urban planning. This influx of investments is driving innovation and expanding the market landscape.

Overall Competitive Scenario

The overall competitive scenario in the remote sensing satellite market is characterized by a balance between established giants and nimble innovators. While traditional aerospace and defense companies continue to dominate, the rise of agile start-ups challenges the status quo. The industry is witnessing a shift towards more accessible and affordable satellite solutions, enabling a broader range of customers to leverage Earth observation data.

The remote sensing satellite market is a dynamic and competitive space, driven by technological advancements, evolving customer demands, and the emergence of new players. Established companies deploy diverse strategies to maintain their dominance, while innovative start-ups contribute to market disruption. Factors such as technological capabilities, global reach, and adaptability to market trends influence market share. Industry news highlights significant developments, and current investment trends underscore the growing interest in advancing satellite capabilities. The overall competitive scenario reflects a balance between traditional industry leaders and agile newcomers, ensuring a vibrant and innovative landscape for remote sensing satellites.

Recent News :

Thales Group have a strong foothold, owing to their extensive experience, technological capabilities, and global reach. These companies offer a wide range of remote sensing satellite solutions, from high-resolution imaging to advanced data analytics services.

Maxar Technologies:

January 6, 2024: Announced a strategic partnership with Umbra Lab to expand its radio-frequency (RF) mapping capabilities. This strengthens Maxar's focus on diverse data sources beyond optical imagery.

November 8, 2023: Signed a contract with Planet Labs to collaborate on advanced analytics and geospatial solutions, combining Planet's vast imagery dataset with Maxar's expertise.

Planet Labs:

December 19, 2023: Revealed its next generation SuperDove constellation, offering even higher resolution and revisit frequency for Earth observation. This strengthens Planet's position as a major provider of near-real-time imagery.

September 27, 2023: Secured a contract with the National Reconnaissance Office (NRO) to assess its capabilities for hyperspectral satellite imagery, indicating potential future collaborations with government agencies.

BlackSky Global:

December 12, 2023: Launched its Genesis-2 Earth observation satellite, further expanding its constellation and providing rapid global revisit frequency. This positions BlackSky as a competitor in the high-resolution imagery market.

July 25, 2023: Announced a partnership with SpaceX to launch its upcoming constellation of high-resolution Earth observation satellites, leveraging SpaceX's Starlink infrastructure.