Market Trends

Key Emerging Trends in the Relay Output Module Market

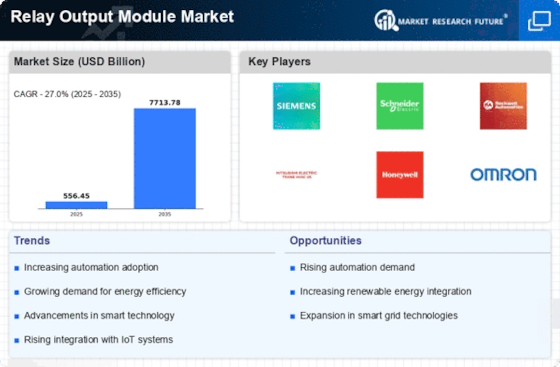

The Relay Output Module industry is experiencing major trends with the increasing demand for industries to improve on automation and control systems utilization. Relay output modules are important elements in these systems since they provide a way of triggering external equipment with an instant switch control; hence, relay output modules play a core role in industrial application. An interesting feature of the described market is a growing need for small interference modules. Companies are looking for solutions that enable them to save space on air conditioners and allow installation flexibility and scalability. Apart from making maximal use of limited free space available in their control panels, compact relays reduce the efforts associated with system integration into complex automation systems. The development of IoT and Industry 4.0 has an important impact on the dynamic relay output module market. As industrial processes increasingly rely on the connectivity of machineries with each other and data, support is needed from relay modules that can transport instructions efficiently to other machines. Relay output modules are becoming smart and manufacturers can keep the track of them across remote locations. This connectivity does not only bring real-time monitoring but also allows to forward the theory of predictive maintenance strategies leading to improved system reliability and reduced downtime. Relay output modules are designed and made operational with a focus on energy conservation in connection with the attention on power saving. With the constant increase in energy consumption, various industries are concerned with both its reduction and optimizing operational processes.

As a response to such development, energy-efficient features of relay output modules are being incorporated in their designs including low power consumption when used as standby and high accuracy for devices switching. These energy critical modules not only help save costs but also work in accordance with global sustainability initiatives. And it can also be stated that while considering industrial applications reliability and durability will always remain of paramount importance even when we discuss the relay output module market. Many features of automaton ethics have now become evident in software systems such as productive parallel execution, configurable task priorities, and optimization principles. This is especially important in industries like manufacturing engineering where relay modules can be made to operate under demanding conditions such as temperatures, humidity, and vibrations among others. The introduction of ruggedized relay output modules guarantees satisfactory performance under harsh conditions in typical highly industrial settings is currently being observed at the market. Another major trend in the relay output module market is integrating features that are state of the art as far as safety aspects developments. Consequently, industries are placing high priority on their operation’s safely and relay modules are cracking under this pressure to keep up with these tight safety standards.

Leave a Comment