Market Analysis

In-depth Analysis of Refurbished Smartphone Market Industry Landscape

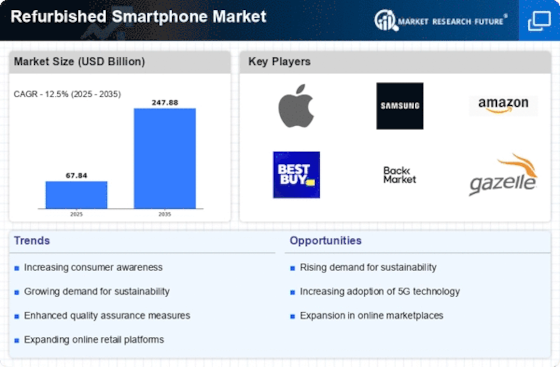

The market environments of the refurbished smartphone business have undergone considerable adjustments in modern years, indicating an escalating drift in consumer behavior and technological incidents. The global market for refurbished smartphones is an unusual section within the substantial mobile phone activity, characterized by the sale of used strategies that have been refurbished to a like-new specification. On the demand side, cost-aware customers are progressively changing to refurbished smartphones as a feasible alternative to brand-new gadgets. The initial allure rests in the considerable cost savings, letting individuals retrieve high-quality smartphones at a part of the original value. In a place where technology advances hurriedly, several users find that refurbished mobile phones present a cost-effective way to stay up to date with the latest traits and capabilities. Supply circumstances in the global market for refurbished smartphones are modeled by a variability of aspects, including returns, trade-ins, and promotions. As consumers upgrade to the latest simulations, their used designs often appear in the refurbishment procedure. The quality of the refurbishment procedure is crucial, as buyers request confidence that the refurbished phones they obtain will complete reliably and meet their prospects. This has led to a spotlight on rigorous quality control actions within the industry.

Moreover, the market circumstances are changed by the convenience of popular smartphone models in the refurbished class. The announcement of new flagship versions repeatedly triggers a surge in the supply of aged devices as users deal in their phones for modern technology. Government regulations and industry guidelines also act as a part of modeling the market circumstances of refurbished smartphones. As the the global market for refurbished smartphones expands, there is an enhanced importance on warranting consumer security, fair trade procedures, and environmental sustainability. The competitive platform of the global market for refurbished smartphones is advancing, with both recognized brands and recent players completing the scene. Established companies repeatedly have dedicated refurbishment suites, leveraging their brand reputation to attract clients. In the end, the market conditions of the global market for refurbished smartphones reflect a delicate balance between consumer demand, technological developments, supply channels, and regulatory frameworks. The continuing evolution of market situations presents openings for businesses to establish trust, innovate, and contribute to a more sustainable and cost-conscious mobile phone ecosystem.

Leave a Comment