- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

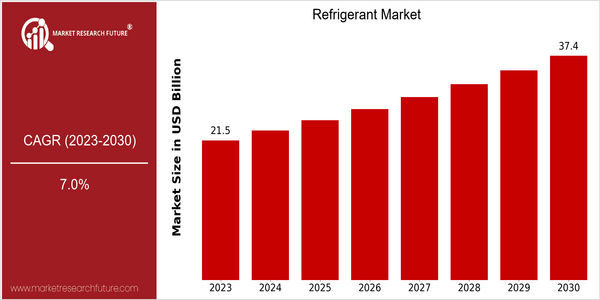

Refrigerant Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 21.5 Billion |

| 2030 | USD 37.4 Billion |

| CAGR (2022-2030) | 7.0 % |

Note – Market size depicts the revenue generated over the financial year

The world refrigerant market is projected to reach $37.4 billion in 2023. Its CAGR is 7.0% for the period from 2022 to 2030. This growth rate reflects a robust demand for refrigerants across various applications, including heating, ventilation, and air conditioning (HVAC), as well as for home and vehicle cooling. The increasing focus on energy efficiency and the transition to green refrigerants are also driving this growth. The development of low-GWP refrigerants and the rising use of natural refrigerants are reshaping the refrigerant market. The phase-down of HFCs and other high-GWP refrigerants is boosting the demand for these new solutions. Industry leaders such as Honeywell, Chemours, and Daikin are stepping up their R&D efforts to develop sustainable refrigerants. Strategic initiatives, such as the formation of new alliances and the launch of new products, are also on the rise. Companies are collaborating to strengthen their product portfolios and to meet evolving regulatory standards. This allows them to take a favorable position in the dynamic refrigerant market.

Regional Deep Dive

Refrigerant is a global market which is experiencing high growth across all regions, owing to the rising demand for cooling systems in residential, commercial and industrial applications. In North America, the stringent regulations for low GWP refrigerants are reshaping the market. In Europe, the F-Gas Regulation is driving the rapid transition to sustainable refrigerants. Asia-Pacific is experiencing high growth on account of the rising demand for air-conditioning systems, owing to the rapid industrial growth and rising per capita income. The Middle East and Africa is witnessing high growth on account of the rising demand for refrigerants, owing to the rapid construction and expansion of the industry. Latin America is gradually adopting sustainable refrigerants, owing to the economic recovery.

North America

- The EPA's Significant New Alternatives Policy (SNAP) program, which encourages the use of low GWP refrigerants, has had a significant effect on market conditions.

- Honeywell and Chemours are investing heavily in the development of HFO (hydrofluoro-olefin) refrigerants, which are considered to be a sustainable alternative to HFCs.

- The growing trend of replacing the old refrigerants of the old air-conditioning systems by more efficient ones is also expected to increase the market demand. As the cost of energy rises, the number of consumers who want to save on their energy bill and reduce their carbon footprint rises.

Europe

- High GWP substances are banned in the European Union by the F-Gas Regulation. The aim is to replace them with alternatives such as natural refrigerants.

- The refrigerants Daikin and GEA Group are the most advanced in the world, and are in compliance with the stricter European regulations.

- In Europe, where there is an increasing concern for the environment and energy conservation, the development of next-generation refrigerants is a growing concern.

Asia-Pacific

- China and India are growing rapidly and are undergoing a rapid industrialization, which explains the increasing demand for air conditioning and refrigerants.

- Cooling Action Plan, which aims to promote the use of environment-friendly refrigerants, is expected to reshape the market.

- The main manufacturers, such as Panasonic and Mitsubishi Electric, are putting their research and development efforts into the development of low-GWP refrigerants, which are suited to the Asian market, and thereby increasing their competitive edge.

MEA

- The construction boom in the Gulf Cooperation Council countries has led to a considerable increase in the demand for refrigerants, especially in the field of air-conditioning.

- In the Gulf countries, such as Saudi Arabia and the United Arab Emirates, the government is encouraging the use of energy-efficient cooling systems, which will drive the shift to low-GWP refrigerants.

- Local companies have started to partner with international companies in order to offer a wider range of refrigerants. This has created a more competitive market.

Latin America

- Latin America is recovering, which is reflected in the increase in public works and in residential construction. This, in turn, has prompted a greater demand for refrigerants in air conditioning.

- In Brazil, the regulations are pushing for the use of more environmentally friendly refrigerants, in line with global trends.

- Local manufacturers are beginning to adopt new refrigerant technology, which is expected to increase market competition and enhance sustainable development in the region.

Did You Know?

“The use of hydrofluorocarbons (HFCs) is currently estimated to be at about 90% of all refrigerants in the world. Due to their high global warming potential, they are being phased out.” — United Nations Environment Programme (UNEP)

Segmental Market Size

The refrigerant market is currently undergoing a dynamic change, especially in the low-global-warming-potential segment. The importance of this segment for the overall market is growing as companies strive to comply with stricter regulatory requirements and consumers’ demands for sustainable solutions. The growth is primarily due to the phase-down of high-GWP refrigerants under the Kigali Amendment and increased awareness of the impact of climate change. The shift is also being driven by advances in alternative refrigerant technology.

At the present time, the low-GWP refrigerants are in the process of being introduced in large numbers. Honeywell and Chemours are the leaders in the development and commercialization of these alternatives. They are used in air conditioning, the cooling of shops and industries and in ice cream machines. The main trend is the regulation of refrigerant use and the various green policies. Among the alternatives are hydrofluoroolefins (HFOs), natural refrigerants such as CO2 and ammonia.

Future Outlook

From 2023 to 2030, the refrigerant market is expected to grow significantly, with the market value expected to increase from $21.4 billion to $37.4 billion, with a strong CAGR of 7%. The main driving force is the growing demand for energy-saving cooling solutions in the residential, commercial and industrial sectors. The temperature rise in the world will increase the demand for efficient cooling and air conditioning systems, thereby promoting market growth. The market penetration of low-GWP refrigerants will reach about 30% in the total market by 2030, driven by the increasingly strict regulatory framework to reduce greenhouse gas emissions.

During the forecast period, the refrigerant market will be shaped by key technological developments and policy initiatives. The transition to natural refrigerants, such as hydrocarbons and ammonia, will continue to gain momentum, backed by government incentives and international agreements, such as the Kigali amendment to the Montreal Protocol. In addition, innovations in refrigerant management systems and leak detection will enhance the efficiency of refrigerated systems and help ensure compliance with the environment regulations. Also, the growing emphasis on sustainable refrigerants will have an impact on the market. These developments will create new opportunities for growth and innovation in the refrigerant market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 7% (2022-2030) |

Refrigerant Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.