Recycling Equipment Size

Recycling Equipment Market Growth Projections and Opportunities

Searching...

What is the current valuation of the Recycling Equipment Market as of 2024?

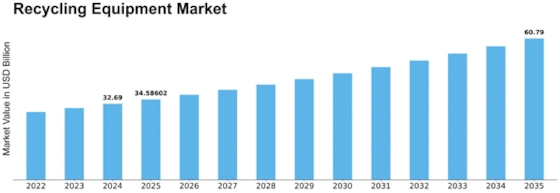

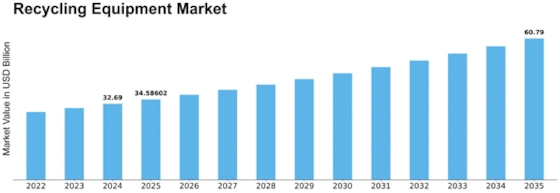

The Recycling Equipment Market was valued at 32.69 USD Billion in 2024.

What is the projected market valuation for the Recycling Equipment Market in 2035?

The market is projected to reach 60.79 USD Billion by 2035.

What is the expected CAGR for the Recycling Equipment Market during the forecast period 2025 - 2035?

The expected CAGR for the Recycling Equipment Market during 2025 - 2035 is 5.8%.

Which segments are included in the Recycling Equipment Market?

The market includes segments such as baler presses, shredders, granulators, and others.

What was the valuation range for baler presses in the Recycling Equipment Market?

The valuation for baler presses ranged from 5.0 to 9.0 USD Billion.

How much is the plastic segment projected to grow in the Recycling Equipment Market?

The plastic segment is projected to grow from 6.0 to 12.0 USD Billion.

As per Market Research Future analysis, the Recycling Equipment Market was estimated at 32.69 USD Billion in 2024. The Recycling Equipment industry is projected to grow from 34.58 USD Billion in 2025 to 60.79 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5% during the forecast period 2025 - 2035

The Recycling Equipment Market is poised for substantial growth driven by technological advancements and increasing regulatory pressures.

| 2024 Market Size | 32.69 (USD Billion) |

| 2035 Market Size | 60.79 (USD Billion) |

| CAGR (2025 - 2035) | 5.8% |

| Largest Regional Market Share in 2024 | Asia Pacific |

Waste Management Inc (US), Veolia Environnement SA (FR), <a href="https://www.suez.com/en/waste/waste-recycling/recycle-materials">SUEZ </a>SA (FR), Republic Services Inc (US), Biffa PLC (GB), <a href="https://www.stericycle.com/en-us/resource-center/blog/recycling-plastic">Stericycle </a>Inc (US), Clean Harbors Inc (US), GFL Environmental Inc (CA), Ceres Global Ag Corp (CA)

The Recycling Equipment Market is currently experiencing a transformative phase, driven by increasing environmental awareness and regulatory pressures. Stakeholders are recognizing the necessity of sustainable practices, which has led to a surge in demand for advanced recycling technologies. This market encompasses a wide array of equipment, including shredders, balers, and sorting systems, all designed to enhance efficiency and effectiveness in waste management. As industries strive to minimize their ecological footprints, the adoption of innovative recycling solutions appears to be a pivotal strategy for achieving sustainability goals. Moreover, the Recycling Equipment Market is likely to witness further evolution as technological advancements continue to emerge. Automation and artificial intelligence are becoming integral components, streamlining operations and improving sorting accuracy. This trend suggests a shift towards more sophisticated systems that not only optimize resource recovery but also reduce operational costs. As the global community increasingly prioritizes circular economy principles, the Recycling Equipment Market is poised for substantial growth, reflecting a broader commitment to environmental stewardship and resource conservation.

The Recycling Equipment Market is seeing a notable shift towards the integration of cutting-edge technologies. Innovations such as automation and artificial intelligence are enhancing operational efficiency and accuracy in sorting processes. These advancements are likely to streamline recycling operations, making them more effective and cost-efficient.

Government regulations are playing a crucial role in shaping the Recycling Equipment Market. Stricter environmental policies and mandates for waste reduction are compelling industries to invest in advanced recycling solutions. This regulatory landscape is fostering a more sustainable approach to waste management.

There is a growing awareness among consumers regarding the importance of recycling and sustainability. This heightened consciousness is driving demand for more efficient recycling equipment. As consumers advocate for environmentally friendly practices, businesses are responding by upgrading their recycling capabilities.

Technological advancements are revolutionizing the Recycling Equipment Market. Innovations such as artificial intelligence, automation, and advanced sorting technologies are enhancing the efficiency and effectiveness of recycling processes. For instance, AI-driven sorting systems can significantly improve material recovery rates, which are crucial for the sustainability of recycling operations. The market for recycling equipment is expected to grow at a compound annual growth rate of 7% from 2025 to 2030, driven by these technological improvements. As equipment becomes more sophisticated, the Recycling Equipment Market is likely to attract new investments and expand its capabilities.

The increasing awareness of environmental issues is driving the Recycling Equipment Market. As societies grapple with the consequences of waste accumulation and pollution, there is a heightened demand for effective recycling solutions. This trend is reflected in the rising investments in recycling technologies, which are projected to reach USD 50 billion by 2026. Governments and organizations are prioritizing sustainability, leading to the development of advanced recycling equipment that can process a wider range of materials. The Recycling Equipment Market is thus positioned to benefit from this shift towards eco-friendly practices, as both public and private sectors seek to mitigate their environmental impact.

Regulatory frameworks play a crucial role in shaping the Recycling Equipment Market. Governments worldwide are implementing stringent regulations aimed at reducing waste and promoting recycling. For instance, many countries have set ambitious recycling targets, which necessitate the adoption of advanced recycling technologies. The European Union's Circular Economy Action Plan, for example, aims to ensure that all packaging is recyclable by 2030. Such policies create a favorable environment for the Recycling Equipment Market, as manufacturers and service providers align their offerings with regulatory requirements. This alignment not only fosters innovation but also enhances market growth opportunities.

The demand for recycled materials is on the rise, significantly impacting the Recycling Equipment Market. Industries such as construction, automotive, and packaging are increasingly utilizing recycled materials to meet sustainability goals and reduce costs. For example, the construction sector is projected to use 30% more recycled materials by 2027, creating a robust market for recycling equipment. This trend not only supports the circular economy but also drives the need for advanced recycling technologies that can efficiently process various materials. Consequently, the Recycling Equipment Market is poised for growth as it adapts to meet this escalating demand.

Investment in waste management infrastructure is a key driver for the Recycling Equipment Market. As urbanization accelerates, cities are recognizing the need for efficient waste management systems to handle increasing waste volumes. Governments and private entities are allocating substantial funds to enhance recycling facilities and equipment. For instance, investments in recycling infrastructure are expected to exceed USD 30 billion by 2028. This influx of capital is likely to spur innovation and improve the overall efficiency of recycling operations. As a result, the Recycling Equipment Market stands to benefit from these developments, positioning itself as a vital component of sustainable waste management.

The Recycling Equipment Market exhibits diverse segments, with baler presses commanding the largest share due to their pivotal role in compressing recyclable materials for efficient storage and transport. Shredders, while following the balers in market share, are witnessing rapid growth driven by the increasing demand for waste processing and material recovery, positioning them as key players in the segment. The adoption of shredders is being fueled by regulations encouraging recycling and the rising need for sustainability in <a href="https://www.marketresearchfuture.com/reports/plastic-waste-management-market-2790">plastic waste management</a>, contributing to their vibrant market presence.

Baler Press (Dominant) vs. Shredders (Emerging)

Baler presses dominate the Recycling Equipment Market segment, known for their efficiency in handling bulk materials and enhancing storage. Their robust design ensures high durability and performance in various recycling setups. Conversely, shredders are emerging rapidly, known for their versatility in processing different types of materials, including plastics and metals. Their increasing use in both industrial and residential waste management reflects a significant shift towards automated recycling processes. As technology advances, shredders are enhancing their capabilities, becoming an essential part of modern recycling facilities.

The processed material segment in the recycling equipment market is notably diverse, with metals holding the largest share due to their high value and recyclability. Plastic also represents a significant portion, driven by increasing concerns over plastic waste and environmental sustainability. Other materials such as paper, rubber, construction waste, and others contribute to the segment, but their shares are comparatively smaller. The market demonstrates a balanced distribution with metals and plastics leading the charge.

Metal (Dominant) vs. Plastic (Emerging)

The metal recycling segment remains dominant in the recycling equipment market, primarily due to the inherent value of metal scrap and its extensive recycling infrastructure. This segment benefits from robust demand across various industries, including automotive and construction. Conversely, the plastic recycling segment is emerging as a fast-growing force, propelled by stringent regulations and consumer awareness regarding plastic waste. Due to technological advancements, recycling processes for plastics are becoming more efficient, making them increasingly viable. The ongoing transition towards a circular economy further enhances both segments' positions, each playing a crucial role in sustainability efforts.

Recycling Equipment Market analysis reveals that North America is the largest market, holding approximately 40% of the global share. The region's growth is driven by stringent regulations promoting recycling and waste management, alongside increasing public awareness of environmental issues. The demand for advanced recycling technologies is also on the rise, supported by government initiatives aimed at reducing landfill waste and enhancing recycling rates. The United States and Canada are the leading countries in this market, with major players like Waste Management Inc and Republic Services Inc dominating the landscape. The competitive environment is characterized by innovation and strategic partnerships among key players, focusing on developing efficient recycling solutions. The presence of established companies ensures a robust supply chain and technological advancements in recycling equipment.

Europe is the second-largest market for recycling equipment, accounting for approximately 30% of the global market share. The region's growth is significantly influenced by the European Union's stringent regulations on waste management and recycling, which aim to achieve a circular economy. Initiatives like the EU Waste Framework Directive are pivotal in driving demand for advanced recycling technologies and equipment across member states. Leading countries in this market include Germany, France, and the UK, where companies like Veolia Environnement SA and SUEZ SA are prominent. The competitive landscape is marked by a focus on innovation and sustainability, with key players investing in new technologies to enhance recycling efficiency. The presence of strong regulatory support fosters a favorable environment for market growth and technological advancements.

Asia-Pacific is witnessing rapid growth in the recycling equipment market, holding approximately 20% of the global share. The region's growth is fueled by increasing urbanization, rising waste generation, and government initiatives promoting recycling and waste management. Countries like China and India are leading this trend, with significant investments in recycling infrastructure and technology to address environmental challenges and improve waste management practices. China Recycling Equipment Market is the largest region, followed by India and Japan. The competitive landscape is evolving, with both local and international players striving to capture market share. Companies are focusing on innovative recycling solutions and technologies to meet the growing demand for efficient waste management. The presence of key players like Clean Harbors Inc and GFL Environmental Inc enhances the competitive dynamics in this burgeoning market.

The Middle East and Africa region is gradually emerging in the recycling equipment market, holding about 10% of the global share. The growth is driven by increasing awareness of environmental sustainability and government initiatives aimed at improving waste management practices. Countries like South Africa and the UAE are leading the charge, implementing policies to enhance recycling rates and reduce landfill waste. In this region, the competitive landscape is still developing, with a mix of local and international players entering the market. Key players are focusing on establishing partnerships and collaborations to enhance their market presence. The region's potential for growth is significant, as governments continue to invest in recycling infrastructure and technology to meet rising waste management demands.

The Recycling Equipment Market is currently characterized by a dynamic competitive landscape, driven by increasing environmental regulations and a growing emphasis on sustainability. Key players such as Waste Management Inc (US), Veolia Environnement SA (FR), and SUEZ SA (FR) are actively shaping the market through strategic initiatives that focus on innovation and regional expansion. Waste Management Inc (US) has positioned itself as a leader in waste-to-energy technologies, while Veolia Environnement SA (FR) emphasizes digital transformation in its operations, integrating advanced technologies to enhance recycling efficiency. SUEZ SA (FR) is also focusing on partnerships to bolster its recycling capabilities, indicating a collective shift towards more sustainable practices among these major players. The business tactics employed by these companies reflect a concerted effort to optimize supply chains and localize manufacturing processes. The Recycling Equipment Market appears moderately fragmented, with a mix of large multinational corporations and smaller regional players. This structure allows for a diverse range of strategies, as key players leverage their resources to influence market dynamics. The collective influence of these companies is significant, as they not only drive innovation but also set industry standards that smaller firms often follow. In August 2025, Waste Management Inc (US) announced a partnership with a leading technology firm to develop AI-driven sorting systems for recycling facilities. This strategic move is likely to enhance operational efficiency and reduce contamination rates in recycled materials, thereby improving the overall quality of recyclables. Such advancements may position Waste Management as a frontrunner in the adoption of smart technologies within the recycling sector. In September 2025, Veolia Environnement SA (FR) launched a new initiative aimed at expanding its recycling services in emerging markets, particularly in Southeast Asia. This expansion is indicative of Veolia's strategy to tap into regions with growing waste management needs, potentially increasing its market share and reinforcing its commitment to global sustainability goals. The initiative may also facilitate knowledge transfer and technology sharing, further enhancing Veolia's operational capabilities. In July 2025, SUEZ SA (FR) completed the acquisition of a regional recycling firm in North America, which is expected to bolster its recycling infrastructure and service offerings. This acquisition aligns with SUEZ's strategy to enhance its operational footprint and diversify its service portfolio, allowing for greater responsiveness to local market demands. The integration of this firm could lead to improved efficiencies and a stronger competitive position in the North American market. As of October 2025, the Recycling Equipment Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming more pronounced. Companies that prioritize innovation and sustainable practices are likely to differentiate themselves in this evolving market, suggesting a future where competitive advantage hinges on adaptability and forward-thinking strategies.

February 2023 A partnership between Flowserve and Clariter was announced with a goal of minimizing or eliminating plastic waste through chemical recycling facilities. They are looking for innovative and environmentally friendly pump and valve lubricant compositions made from recovered plastic waste.

December 2022 A pilot facility for the chemical recycling of acrylic resin was built by Sumitomo Chemical. This is a significant effort to gather acrylic plastic scraps and use recycling technology on them, showing off the most recent advancements in plastic recycling equipment.

The Recycling Equipment Market size is projected to grow at a 5.8% CAGR from 2024 to 2035, driven by increasing environmental regulations, technological advancements, and rising consumer awareness.<br>The future of the Recycling Equipment Market is robust, driven by stringent global waste mandates and the shift toward circular economies. Growth in the market is fueled by the adoption of AI-driven sorting robotics, modular units for urban centers, and advanced chemical recycling systems.

New opportunities lie in:

By 2035, the market is expected to be robust, driven by innovation and sustainability initiatives.

| MARKET SIZE 2024 | 32.69(USD Billion) |

| MARKET SIZE 2025 | 34.58(USD Billion) |

| MARKET SIZE 2035 | 60.79(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.8% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Waste Management Inc (US), Veolia Environnement SA (FR), SUEZ SA (FR), Republic Services Inc (US), Biffa PLC (GB), Stericycle Inc (US), Clean Harbors Inc (US), GFL Environmental Inc (CA), Ceres Global Ag Corp (CA) |

| Segments Covered | Equipment, Processed Material, Region |

| Key Market Opportunities | Integration of advanced automation technologies enhances efficiency in the Recycling Equipment Market. |

| Key Market Dynamics | Technological advancements and regulatory pressures drive innovation and competition in the Recycling Equipment Market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

What is the current valuation of the Recycling Equipment Market as of 2024?

The Recycling Equipment Market was valued at 32.69 USD Billion in 2024.

What is the projected market valuation for the Recycling Equipment Market in 2035?

The market is projected to reach 60.79 USD Billion by 2035.

What is the expected CAGR for the Recycling Equipment Market during the forecast period 2025 - 2035?

The expected CAGR for the Recycling Equipment Market during 2025 - 2035 is 5.8%.

Which segments are included in the Recycling Equipment Market?

The market includes segments such as baler presses, shredders, granulators, and others.

What was the valuation range for baler presses in the Recycling Equipment Market?

The valuation for baler presses ranged from 5.0 to 9.0 USD Billion.

How much is the plastic segment projected to grow in the Recycling Equipment Market?

The plastic segment is projected to grow from 6.0 to 12.0 USD Billion.

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Metal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Germany Outlook (USD Billion, 2024-2032)

Recycling Equipment by EquipmentBaler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Baler Press

Shredders

Granulators

Agglomerators

Shears

Separators

Extruders

Others

Recycling Equipment by Processed MaterialMetal

Plastic

Construction Waste

Paper

Rubber

Others

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment