Market Trends

Key Emerging Trends in the Recombinant Vaccines Market

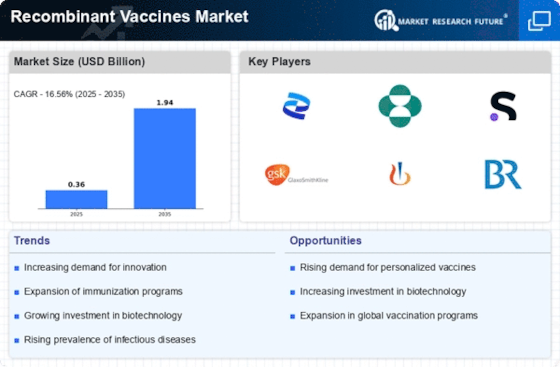

In recent years, there have been significant changes in the recombinant vaccine market along with improvements in vaccine technology, greater demand for preventive medicine and increased global interest in vaccine development and distribution. Recombinant vaccines derived from genetically engineered microorganisms expressing specific antigens have gained popularity due to their safety, efficacy and scalability.

One area of interest is increasing attention on vaccine research for emerging infectious diseases. The COVID-19 pandemic has emphasized the urgency of the need for vaccines resulting into rapid production and introduction of recombinant vaccines against SARS-CoV-2 virus. This context has driven ongoing ability to innovate and adjust the sales of recombinant vaccination with more stabs at upcoming new pathogens as well as likely outbreaks.

Advancements in technology have therefore played a critical role in shaping this market segment which deals with recombinant vaccines. For instance, through utilization of latest biotechnological tools such as CRISPR-Cas9 gene-editing technique and synthetic biology, it has allowed for faster product development leading to better immunogenicity-based vaccines. These technology trends also improve not only efficiency in vaccine manufacture but also enable next-generation recombinant vaccines that are effective against different strains to be developed.

Collaboration and cooperation across the pharmaceuticals and biotechnology industries were key features within theoretical constructs influencing the world’s third largest therapeutic class, recombinant vaccines business today. Strategic alliances between different companies academic and research institutions are responsible collaborative approaches towards developing vaccinations. These partnerships help combine resources, expertise and infrastructure for quicker researches clarifying how best these products may be commercialized within a very short period thus reducing time-to-market for new drugs produced by combining genetic material from microorganisms. This trend will continue thereby accelerating vaccine innovation.

The emphasis on preventive healthcare coupled with an increasing awareness about vaccination value explains why there has been an uptick in uptake rates when it comes to usage of recombined vaccines. Vaccination programs are being pushed by governments, public health entities companies among other private sector enterprises to help prevent infectious diseases spread and relieve the healthcare system of such stresses. The focus on prevention along with heightened public awareness of vaccine effectiveness and safety are fueling demand for recombinant vaccines as a preferred means of disease prevention.

Another trend in this market is moving towards the development of non-communicable disease vaccines. Studies have shown that recombinant vaccines can be useful in treating cancers, allergic disorders and autoimmune illnesses. This expansion away from infections only shows how flexible these platforms are in making recombinant vaccines capable of addressing various health issues at hand.

The whole world is calling for improved access and affordability of vaccines as one of the vital trends in the recombinant vaccine market. Initiatives like COVAX aim at ensuring that everyone has equal opportunities to get vaccinated especially those from low-income and middle-income countries. This global commitment not only addresses public health concerns but also builds stronger sustainable and inclusive markets for recombinant vaccines.

Regulatory drivers as well as advancements are important factors influencing the development of this market dealing with recombined vaccinations. To date, regulatory agencies worldwide have been reformulating their frameworks to accommodate peculiarities associated with recombined vaccination products .Such reforms include fast-tracking approval processes, increased collaboration between regulators and manufacturers, designing clear-cut regulatory pathways leading into faster marketing environment for these products than anticipated by many people everywhere thus leading to a situation whereby recombinants enter commerce swifter than we expect them to do so.

Leave a Comment