Market Analysis

In-depth Analysis of Reciprocating Compressor Market Industry Landscape

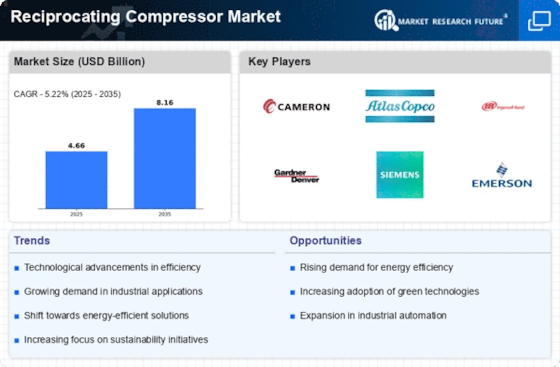

The reciprocating compressor market is set to reach US$ 7.0 BN by 2032, at a 5.90% CAGR between years 2023-2032. The market is dynamic and rapidly changing in the direction of developed trends that determine its dynamics. This section of the compressor market has experienced significant growth overtime due to various industrial applications, demand for compressed air and gases. A major driver of market dynamics is the growing scope of industry applications, including oil and gas, petrochemicals manufacturing energy. The reciprocating compressor market continues to be driven by the oil and gas industry. As the worldwide demand for energy grows, compressor solutions that oil & gas exploration and extraction activities need to be more resilient. The reciprocating compressors can also be used in upstream and downstream processes due to their high efficiency rates and or reliability. Therefore, these market players are constantly innovating to create reciprocating compressors that conform to the rigorous standards of this industry. Additionally, the petrochemical industry is a major determining factor in developing market trends. Reciprocating compressors are vital in many petrochemical processes including refining, chemical production among other. Specialty chemicals and refined products also necessitate advanced compression technologies to satisfy the increased demand. In this way, manufacturing companies target making reciprocating compressors capable of dealing with a variety of gases suitable for different petrochemical applications requiring high-performance. In the manufacturing industry, reciprocating compressors are used for air and gas compression that comes into play in numerous processes. These compressors fulfil the varied requirements of manufacturing units ranging from pneumatic tools to assembly line operations. The market dynamics is driven by the increasing attention towards energy efficiency and sustainable manufacturing practices. In response, manufacturers are building better reciprocating compressors that have features such as variable speed drives and improved control systems to mitigate the issue of energy waste. The evolving energy landscape affects the reciprocating compressor market as well. There is a transition towards the development of compressors to accommodate alternative fuels and green energy applications, owing to concern for cleaner sources. T his development is encouraging manufacturers to spend on R&D to develop reciprocating compressors that are in tandem with the objectives of sustainable energy. Factors which further shape the market dynamics are technological upgrades and digitalization. The incorporation of smart technologies, IoT (Internet of Things), and predictive maintenance solutions in reciprocating compressors improves their performance, efficiency as well as reliability. This digitization in the sector does not only enhance efficiency but also increases market growth. Besides this, global economic situations and regulatory environments similarly have a significant impact on the reciprocating compressor market. Commodity prices, trade policies and environmental regulations vary between investment options influencing the market trends. These external factors play an important role to the manufacturers and end-users who observe their trends in order that they can develop strategies accordingly for remaining competitive in this dynamic market.

Leave a Comment