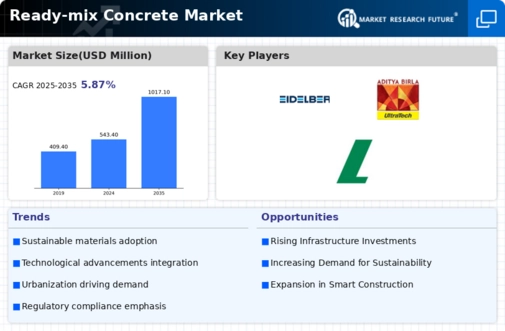

Top Industry Leaders in the Ready-mix Concrete Market

Ready Mix Concrete Market

The competitive landscape of the ready mix concrete market is complex and dynamic. The market is dominated by a few large players, but new and emerging companies are entering the market and challenging the traditional leaders. Companies are investing in new technologies, products, and services to differentiate themselves from the competition and capture market share. The industry is also becoming more consolidated, and the market is expanding into new geographies. The overall competitive scenario is characterized by intense competition, innovation, and growth.

Strategies adopted:

-

Focus on innovation: Leading players are investing heavily in research and development to develop new and improved ready mix concrete products and technologies. This includes the development of self-compacting concrete, high-performance concrete, and sustainable concrete solutions. -

Geographic expansion: Many companies are expanding their operations into new geographic markets to tap into growing demand. This includes emerging markets such as Asia, Africa, and South America. -

Mergers and acquisitions: Mergers and acquisitions are a common strategy in the ready mix concrete market as companies seek to consolidate their market share and gain access to new technologies and resources. -

Sustainability: Companies are increasingly focusing on sustainability initiatives to reduce their environmental footprint and meet the growing demand for eco-friendly products. This includes the use of recycled materials, alternative fuels, and energy-efficient technologies. -

Digitalization: Companies are adopting digital technologies to improve efficiency, productivity, and customer service. This includes the use of online ordering platforms, mobile apps, and data analytics tools.

Factors for market share:

-

Brand reputation: Well-established brands with a strong reputation for quality and reliability command a higher market share. -

Product portfolio: Companies with a wide range of products and services are better positioned to meet the needs of different customers. -

Geographic reach: Companies with a global presence are able to tap into growing demand in different markets. -

Innovation: Companies that are at the forefront of innovation and offer new and improved products are able to gain a competitive edge. -

Price competitiveness: Companies with competitive pricing strategies are able to attract more customers.

List of the Key Companies in the Ready-mix Concrete market includes

- ACC Limited (India)

- Vicat SA (France)

- Lafarge (France)

- Buzzi Unicem S.p.A. (Italy)

- Barney & Dickenson Inc.(U.S.)

- W. Sidley Inc. (U.S.)

- CEMEX S.A.B. de C.V.( Mexico)

- Italcementi Group (Italy)

- UltraTech Cement Limited

- Holcim Ltd.( Switzerland)

- HeidelbergCement (Germany) among Infrastructure

Recent Development

October 2023:

Cemex: Declares the send off of its new "Vertua" low-carbon concrete in North America. This item has an essentially lower carbon impression than customary substantial blends.

Holcim: Gains a greater part stake in Total Businesses, a UK-based development materials organization, for $3.4 billion. The move grows Holcim's presence in the European market.

September 2023:

HeidelbergCement: Declares an organization with Volvo Development Hardware to foster electric blender trucks. This coordinated effort plans to lessen ozone harming substance discharges from substantial creation and transport

April 2023– Hanson Group provided a ready mix to address problems related to COVID-19 in Swansea. The site is temporarily being constructed as an NHS temporary field hospital to treat and look after patients suffering from the newly emerging novel coronavirus.

April 2023–As a means to come together and assist those who are affected by the COVID-19 pandemic, Ambuja Cement and ACC Limited, the two heavyweights of global cement manufacturing, joined forces. The corporations will make together a financial contribution of Rs. 3.30 crore to three Indian NGOs focused on assisting the migrants and daily wage workers.

In June 2023, Buzzi SpA, through its wholly owned subsidiary Dyckerhoff GmbH, entered an agreement with CRH, a leading supplier in the building materials market, on the disposal of certain selected activities in Eastern Europe. The transaction involves sales and disposals of assets in Ukraine and operators of ready-mix concrete businesses in eastern Slovakia. The completion of the transaction in Ukraine will be finalized only after obtaining the necessary approvals and will occur in the year 2024. This initiative is in line with Buzzi’s other business strategies directed toward improving the company’s operational focus.