Top Industry Leaders in the Reactive Diluents Market

The market for reactive diluents, chemicals that become part of the final product upon reaction, showcases a dynamic and evolving landscape. it attracts competition from established players and innovative newcomers alike.

The market for reactive diluents, chemicals that become part of the final product upon reaction, showcases a dynamic and evolving landscape. it attracts competition from established players and innovative newcomers alike.

Competitive Strategies Afoot:

-

Product Diversification: Leading players like Hexion and Huntsman are expanding their portfolios beyond core epoxy diluents, foraying into bio-based and specialty diluents to cater to diverse application needs and stricter environmental regulations. -

Vertical Integration: Companies like Aditya Birla Chemicals are integrating upstream through raw material acquisition to secure supply chains and optimize costs, offering competitive pricing advantages. -

Regional Expansion: Asia Pacific emerges as a growth engine, attracting investments from global players like Evonik and Adeka. Companies are establishing local production facilities and distribution networks to tap into the region's booming construction and infrastructure sectors. -

Technological Advancements: R&D efforts focus on developing diluents with improved performance, lower VOCs, and enhanced sustainability. For instance, Cargill's new bio-based diluent offers reduced dependence on fossil fuels and improved adhesion properties. -

Collaboration and Partnerships: Strategic alliances are a growing trend. Huntsman partnered with Kukdo Chemical to leverage their combined market expertise and product portfolios, particularly in epoxy resins.

Market Share Drivers:

-

Application Diversification: Reactive diluents find use in paints and coatings, adhesives and sealants, composite materials, and electronic potting compounds. Expanding applications beyond traditional epoxy resins, like in wind turbine blades and electric vehicle components, drive market growth. -

Regional Trends: The Asia Pacific region spearheads the market, fueled by rapid urbanization and industrialization. China, India, and Southeast Asian countries present lucrative opportunities for reactive diluents manufacturers. -

Environmental Regulations: Stringent VOC emission regulations in Europe and North America are pushing manufacturers towards developing low-VOC and bio-based diluents, fostering innovation and market differentiation. -

Demand for High-Performance Materials: The increasing demand for lightweight, high-strength composites in industries like aerospace and automotive, where reactive diluents play a crucial role, bolsters market growth.

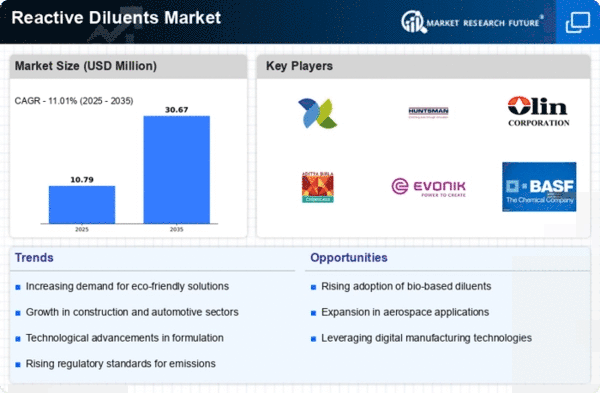

Key Players

- Arkema Group

- Huntsman International LLC

- Olin Corporation

- Cardolite

- Epoxy Division

- Aditya Birla Chemicals Limited

- Nippon Shokubai Co. Ltd.

- Cargill Incorporated

- Evonik Industries AG

Recent Developments :

July 2023: Huntsman and Cargill team up to develop a novel bio-based diluent for use in electronic potting compounds, aiming to replace petroleum-derived options.

September 2023: The European Chemicals Agency proposes stricter regulations on certain reactive diluents due to health concerns, potentially impacting the market landscape.

November 2023: Aditya Birla Chemicals acquires a reactive diluent manufacturing facility in South Korea, marking its entry into the Asia Pacific market.