Increased Cyber Threats

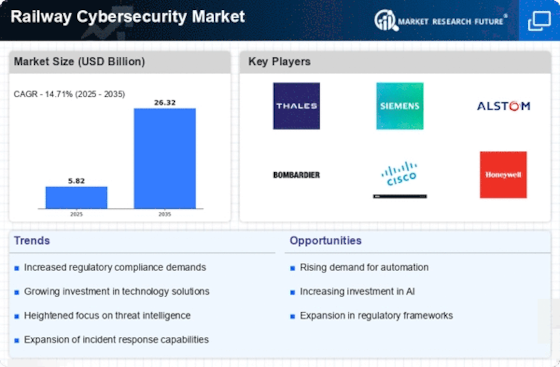

The Railway Cybersecurity Market is experiencing heightened concern due to the increasing frequency and sophistication of cyber threats. As rail systems become more interconnected and reliant on digital technologies, they become attractive targets for cybercriminals. Reports indicate that cyberattacks on critical infrastructure, including railways, have surged, prompting operators to invest significantly in cybersecurity measures. The market is projected to grow as organizations seek to protect sensitive data and ensure operational continuity. This trend underscores the necessity for robust cybersecurity frameworks to mitigate risks associated with potential breaches, thereby driving demand within the Railway Cybersecurity Market.

Technological Advancements

The Railway Cybersecurity Market is significantly impacted by rapid technological advancements. Innovations in artificial intelligence, machine learning, and blockchain are being integrated into cybersecurity solutions, enhancing the ability to detect and respond to threats in real-time. The adoption of these advanced technologies is expected to streamline operations and improve the overall security posture of railway systems. As organizations recognize the potential of these technologies to mitigate risks, investment in cybersecurity solutions is anticipated to rise. This trend indicates a shift towards more proactive and adaptive cybersecurity strategies within the Railway Cybersecurity Market.

Regulatory Compliance Requirements

The Railway Cybersecurity Market is influenced by stringent regulatory compliance requirements imposed by governmental bodies. Authorities are increasingly mandating that railway operators implement comprehensive cybersecurity measures to safeguard against potential threats. Compliance with these regulations not only protects infrastructure but also enhances public trust in rail services. The market is likely to expand as companies invest in solutions that ensure adherence to these evolving standards. As regulations become more rigorous, the need for specialized cybersecurity services and technologies will likely increase, further propelling growth in the Railway Cybersecurity Market.

Growing Investment in Infrastructure

The Railway Cybersecurity Market is benefiting from increased investment in railway infrastructure. Governments and private entities are allocating substantial resources to modernize rail systems, which includes enhancing cybersecurity measures. This investment is driven by the need to protect critical infrastructure from cyber threats and ensure safe operations. As new systems are deployed, the demand for integrated cybersecurity solutions is expected to grow. The market is likely to see a surge in the development of innovative cybersecurity technologies tailored for the railway sector, reflecting the importance of safeguarding these vital assets within the Railway Cybersecurity Market.

Collaboration Among Industry Stakeholders

The Railway Cybersecurity Market is witnessing a trend of collaboration among various stakeholders, including government agencies, railway operators, and cybersecurity firms. This collaboration aims to share knowledge, resources, and best practices to enhance overall cybersecurity resilience. Joint initiatives and partnerships are emerging to address common challenges and develop standardized protocols for cybersecurity in railways. Such collaborative efforts are likely to foster innovation and accelerate the development of effective cybersecurity solutions. As stakeholders work together to strengthen defenses, the Railway Cybersecurity Market is expected to experience growth driven by shared expertise and collective action.