- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

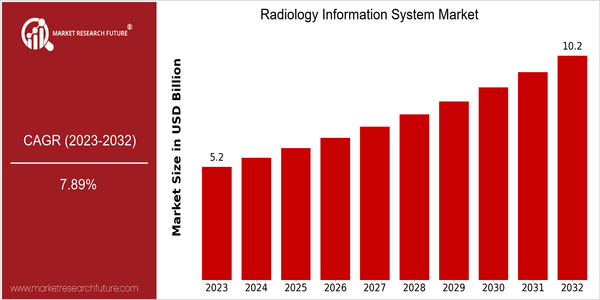

Radiology Information System Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 5.15 Billion |

| 2032 | USD 10.2 Billion |

| CAGR (2024-2032) | 7.89 % |

Note – Market size depicts the revenue generated over the financial year

The RIS market is expected to reach a value of $ 5.15 billion by 2023 and to reach $ 10.2 billion by 2032, registering a CAGR of 7.89% between 2024 and 2032. The rapid development of this market is due to the increasing demand for effective hospital management and the growing prevalence of chronic diseases requiring radiographic diagnosis. The market is also driven by technological developments in the field of medical imaging, the integration of artificial intelligence into radiological workflows, and the growing importance of patient-centered care. The introduction of cloud-based RIS solutions and the interoperability of RIS and EHR systems are expected to increase operational efficiency and improve patient outcomes. RIS market leaders such as Siemens Healthineers, GE Health, and Philips Health are investing heavily in research and development, forming strategic alliances, and launching new products to take advantage of these opportunities. For example, Siemens Healthineers has recently introduced a number of artificial intelligence-based features to its RIS, which will help to optimize radiological processes and increase diagnostic accuracy.

Regional Deep Dive

The Radiology Information System (RIS) market is undergoing significant growth across various regions, mainly driven by technological advancements in the medical industry, rising demand for effective patient management systems, and the increasing prevalence of chronic diseases. In North America, the market is characterized by high penetration of digital health solutions and the presence of key players, while Europe is witnessing a surge in government support for health IT initiatives. The Asia-Pacific region is rapidly developing as the economies of emerging economies are investing in the healthcare industry. The Middle East and Africa are focusing on improving healthcare delivery through innovation. Latin America is gradually adopting RIS solutions, mainly driven by the need for enhanced healthcare services and digital transformation initiatives.

North America

- RIS has been a key part of the U.S. government's efforts to improve the sharing of information between health care systems, which has had a significant impact on the adoption of RIS solutions.

- And RIS is a good example. Cerner and Allscripts are investing in cloud-based RIS, which improves the availability and scalability of RIS for hospitals.

- The increasing demand for value-based care is pushing hospitals to adopt RIS systems, which improve operational efficiency and patient outcomes.

Europe

- The European Union’s digital single market strategy is fostering the integration of digital health solutions across its member states, including RIS.

- Artificial intelligence (AI) is being integrated into RIS platforms, with companies like Siemens Healthineers being at the forefront of the development.

- The new General Data Protection Regulation (GDPR) will also have an effect on the way patient data is managed in the RIS. Data protection is therefore a matter of great importance.

Asia-Pacific

- In India and China, governments are investing heavily in health care. In both countries, the government is encouraging the digitization of medical records, which in turn will drive the RIS market.

- Telemedicine and remote diagnosis have been accelerated by the COVID-X pandemic, which has led to a growing demand for integrated RIS systems capable of supporting virtual consultations.

- The RIS market in the region is booming, with local players like eHealth Technologies developing RIS solutions to meet the specific needs of the local healthcare systems.

MEA

- IT systems in the health sector are expected to grow in the coming years. The UAE's Vision 2021 initiative has placed digital health at the forefront of its development plans, leading to an increased investment in RIS systems to improve the delivery of health services.

- Local governments are collaborating with international IT companies to develop new solutions that are tailored to the region’s unique health care needs.

- The growing prevalence of lifestyle-related diseases is prompting the medical establishment in the Middle East to adopt RIS systems, which help in patient management and treatment planning.

Latin America

- Brazil and Mexico are establishing national health policies that are encouraging the use of digital health technology, including RIS, to improve access to care.

- The emergence of private health care institutions in the region has led to increased competition, and to the increased use of advanced RIS solutions to improve service delivery.

- Locally-based start-ups and established technology companies are collaborating to bring innovations to the RIS that are specifically adapted to regional health care needs.

Did You Know?

“Radiology information systems are now used in more than 70 percent of all medical decisions.” — American College of Radiology

Segmental Market Size

Radiology Information System (RIS) plays a crucial role in the health information system. It manages the data and work flow of medical images. This market is currently growing steadily, as the need for efficient patient management and increased diagnostic capabilities increases. The demand for RIS is also being driven by the growing prevalence of chronic diseases that require more sophisticated diagnostic tools, as well as by government initiatives that promote the use of health information systems and interoperability between different health systems.

The current implementation of RIS is a mature industry, with the largest implementations in North America and Europe, where Cerner and Siemens are leading the market. The main applications of RIS are the management of patient records, the tracking of images and the preparation of reports, which simplify the work of radiologists and improve the quality of the radiographic image. The digital transformation of the health system, which has been accelerated by the swine flu pandemic, and the government's implementation of EHRs, has also contributed to the development of RIS. The development of cloud computing and artificial intelligence has also promoted the development of RIS, and has enhanced its data analysis and operational efficiency.

Future Outlook

The radiology information system market is projected to grow at a CAGR of 7.89% from 2023 to 2032. The growing demand for efficient radiology information systems, the increasing prevalence of chronic diseases requiring advanced diagnostic tools, and the ongoing digital transformation of hospitals are the main growth drivers of the market. The penetration of radiology information systems is expected to increase substantially, reaching over 60% in the key healthcare markets by 2032.

The development of RIS, such as the integration of artificial intelligence and machine learning, will also have a revolutionary effect on the market. The application of these new techniques will lead to a more accurate diagnosis, more accurate prediction of patient outcomes, and thus increase the value of RIS. Furthermore, the interoperability of medical devices and the demand for interoperability in the field of health care, which is driven by the standards and policies of governments, will also promote the use of RIS. In addition, the trend of cloud computing and the trend of patient-oriented care will also have a great influence on the development of the RIS market. In the future, the RIS market will grow rapidly, and the market will bring considerable opportunities to all parties in the value chain.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 11.20% : 2030 |

Radiology Information System Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.