Radar Simulator Size

Market Size Snapshot

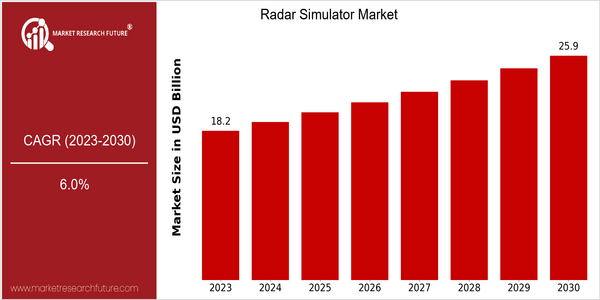

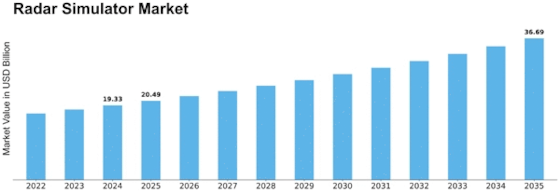

| Year | Value |

|---|---|

| 2023 | USD 18.232 Billion |

| 2030 | USD 25.8624 Billion |

| CAGR (2023-2030) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

The global radar simulator market is currently valued at approximately USD 18.232 billion in 2023 and is projected to reach USD 25.8624 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.0% over the forecast period. This growth trajectory indicates a robust demand for radar simulation technologies, driven by advancements in defense and aerospace sectors, as well as increasing applications in automotive and maritime industries. The rising need for enhanced training solutions and the integration of sophisticated radar systems into various platforms are key factors propelling this market forward.

Technological innovations, such as the development of high-fidelity simulation environments and the incorporation of artificial intelligence in radar systems, are significantly influencing market dynamics. Companies like Northrop Grumman, Raytheon Technologies, and Thales Group are at the forefront of these advancements, actively engaging in strategic initiatives such as partnerships, investments in R&D, and the launch of next-generation radar simulators. These efforts not only enhance operational capabilities but also cater to the evolving requirements of military and civilian applications, thereby solidifying the market's growth potential.

Regional Market Size

Regional Deep Dive

The Radar Simulator Market is experiencing significant growth across various regions, driven by advancements in technology, increasing defense budgets, and the rising demand for training and simulation solutions. In North America, particularly the United States, the market is characterized by a strong presence of key players and government initiatives aimed at enhancing military readiness. Europe is witnessing a surge in collaborative defense projects and investments in simulation technologies, while the Asia-Pacific region is rapidly adopting radar simulation for both military and civilian applications, influenced by regional security dynamics. The Middle East and Africa are seeing growth due to increasing defense expenditures and modernization efforts, while Latin America is gradually embracing radar simulation technologies as part of broader defense and security strategies.

Europe

- The European Union's defense initiatives, such as the Permanent Structured Cooperation (PESCO), are fostering collaboration among member states to develop advanced simulation technologies, including radar simulators, to enhance joint military capabilities.

- Countries like Germany and France are investing heavily in next-generation radar systems and simulators, with companies like Thales and Airbus Defence and Space playing pivotal roles in these developments.

Asia Pacific

- Countries such as India and Japan are ramping up their defense spending, leading to increased procurement of radar simulators for training purposes, with local firms like Hindustan Aeronautics Limited (HAL) and Mitsubishi Heavy Industries making significant contributions.

- The growing focus on indigenous defense manufacturing in nations like South Korea is driving the development of advanced radar simulation technologies, supported by government initiatives aimed at reducing reliance on foreign systems.

Latin America

- Countries like Brazil and Chile are beginning to adopt radar simulators as part of their military training programs, influenced by a growing recognition of the importance of advanced simulation technologies in defense.

- The region is witnessing collaborations between local defense contractors and international firms to develop tailored radar simulation solutions that meet specific regional security needs.

North America

- The U.S. Department of Defense has increased its investment in advanced training systems, including radar simulators, to enhance operational readiness and reduce training costs, with companies like Northrop Grumman and Raytheon leading the charge.

- Recent innovations in artificial intelligence and machine learning are being integrated into radar simulators, allowing for more realistic training scenarios and improved decision-making processes for military personnel.

Middle East And Africa

- The UAE and Saudi Arabia are investing in advanced military training programs, including radar simulators, as part of their broader defense modernization efforts, with companies like CAE and Thales providing cutting-edge solutions.

- The increasing geopolitical tensions in the region are prompting nations to enhance their military capabilities, leading to a surge in demand for radar simulation technologies to prepare armed forces for various operational scenarios.

Did You Know?

“Radar simulators can replicate a wide range of environmental conditions, including weather effects and electronic warfare scenarios, providing military personnel with a comprehensive training experience.” — Military Training and Simulation Journal

Segmental Market Size

The Radar Simulator Market is a crucial segment within the broader defense and aerospace industry, currently experiencing stable growth due to increasing demand for advanced training solutions. Key drivers include the rising need for realistic training environments for military personnel and the growing emphasis on safety and efficiency in air traffic management. Additionally, regulatory policies mandating enhanced training protocols further bolster demand for radar simulation technologies.

Currently, the market is in a mature adoption stage, with notable leaders such as Northrop Grumman and Thales Group implementing radar simulators in various military and civilian applications. Primary use cases include pilot training for military aircraft, air traffic control simulations, and maritime navigation training. Trends such as the integration of artificial intelligence and machine learning into simulation technologies are accelerating growth, while government initiatives aimed at modernizing defense capabilities serve as catalysts. Technologies like virtual reality and cloud-based simulation platforms are shaping the evolution of this segment, enhancing the realism and accessibility of training solutions.

Future Outlook

The Radar Simulator Market is poised for significant growth from 2023 to 2030, with a projected market value increase from $18.232 billion to $25.8624 billion, reflecting a compound annual growth rate (CAGR) of 6.0%. This growth trajectory is underpinned by the increasing demand for advanced training solutions in military and defense sectors, where radar simulators are essential for enhancing operational readiness and tactical decision-making. As nations continue to invest in modernizing their defense capabilities, the adoption of radar simulation technologies is expected to penetrate deeper into both military and civilian applications, including air traffic control and automotive safety systems, potentially reaching usage rates of over 30% in these sectors by 2030.

Key technological advancements, such as the integration of artificial intelligence and machine learning into radar simulation systems, are anticipated to drive market expansion. These innovations will enable more realistic training environments and improve the accuracy of simulations, thereby enhancing user experience and operational efficiency. Additionally, supportive government policies aimed at bolstering defense capabilities and promoting research and development in simulation technologies will further catalyze market growth. Emerging trends, including the shift towards virtual and augmented reality in training programs, are also expected to reshape the landscape of the radar simulator market, making it a dynamic and rapidly evolving sector through the end of the decade.

Leave a Comment