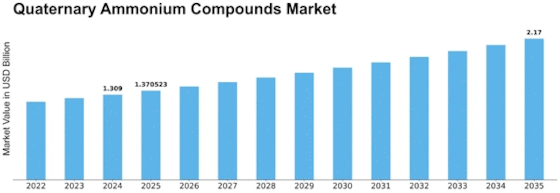

Quaternary Ammonium Compounds Size

Quaternary Ammonium Compounds Market Growth Projections and Opportunities

Different causes have an impact on the dynamics of Quaternary Ammonium Compounds (QAC) market. They are extensively used as disinfectants, surfactants and fabric softeners among others due to their diverse utilization in different areas. The key driving force for the QAC market is the increasing focus on cleanliness and sanitation across various sectors like healthcare, food and beverage industry as well as water treatment plants. With more awareness about disinfection and antimicrobial properties, demand for QACs has increased because it can control a wide range of microorganisms.

The QAC market dynamics are highly influenced by technological advancements in chemical synthesis. Ongoing research focused on enhancing efficiency, specificity, and environmental sustainability of QAC production processes through innovation in molecular design, formulation techniques, and green chemistry practices towards improved performance while minimizing concerns related to environmental impact or biodegradability.

One of these factors includes especially public health problems such as mitigating infection diseases have boosted the growth of this market globally as well as other factors.The emergence COVID-19 pandemic has made people realize the need for effective disinfectants with Lysol becoming one of the most sought after in the market.The market therefore responds to the public health imperative in offering antimicrobial products which help to reduce the rate of infection spread.

The QAC market is also influenced by customer preferences and industry trends. The desire for disinfectants that are safe, easy to use and have long lasting effects has prompted innovations in QAC formulations that cater to this consumer need. The need for products with effective and convenient antimicrobial solutions has seen increasing applications of QACs in household disinfectants, surface sanitizers and personal care products.

Thus, competition in chemical industry creates dynamics of QAC market whereby companies spend on research and development (R&D) leading to innovative formulations of quats as well as improving their efficiency/ efficacy level, particularly, alongside changing regulatory framework. Therefore, it is necessary to establish strong relationships with such industries as healthcare, hospitality, manufacturing so that they may be able to get a significant share on the market for some specific quaternary ammonium compounds.

Leave a Comment