Regulatory Compliance

Regulatory frameworks governing chemical manufacturing and environmental safety are influencing the Amino Resin Market. Stricter regulations regarding emissions and product safety are prompting manufacturers to innovate and reformulate their products. Compliance with these regulations not only ensures market access but also enhances brand reputation among consumers. Companies that proactively adapt to these regulatory changes may find themselves at a competitive advantage, as they can offer products that meet or exceed safety standards. This trend is expected to drive growth in the amino resin market, as businesses increasingly prioritize compliance in their operational strategies.

Technological Innovations

Technological advancements in the production and application of amino resins are likely to propel the Amino Resin Market forward. Innovations such as improved curing processes and enhanced formulation techniques are enabling manufacturers to produce resins with superior properties, including better adhesion, durability, and resistance to environmental factors. These advancements not only enhance product performance but also reduce production costs, making amino resins more appealing to various industries. The market is expected to witness a surge in demand, particularly in sectors such as automotive and construction, where high-performance materials are essential. This trend indicates a robust growth trajectory for the industry.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Amino Resin Market. Manufacturers are increasingly adopting eco-friendly practices, which include the use of bio-based raw materials and the reduction of volatile organic compounds in production processes. This shift not only aligns with regulatory requirements but also caters to the growing consumer demand for sustainable products. As a result, the market for amino resins is projected to expand, with estimates suggesting a compound annual growth rate of around 5% over the next few years. Companies that prioritize sustainability may gain a competitive edge, as they are likely to attract environmentally conscious consumers and businesses.

Diverse Application Spectrum

The expanding range of applications for amino resins is a significant driver for the Amino Resin Market. These resins are utilized in various sectors, including coatings, adhesives, and textiles, which broadens their market appeal. For instance, the automotive industry increasingly employs amino resins for their lightweight and durable properties, while the furniture sector benefits from their excellent finish and resistance to wear. Market data suggests that the coatings segment alone accounts for a substantial share of the amino resin market, with projections indicating continued growth as industries seek versatile and high-performance materials. This diversification is likely to sustain market momentum.

Economic Growth in Emerging Markets

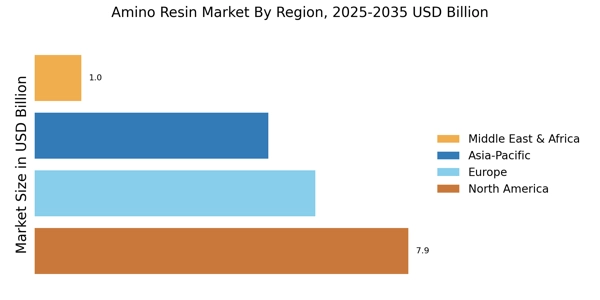

The economic development in emerging markets is likely to serve as a catalyst for the Amino Resin Market. As these regions experience industrialization and urbanization, the demand for construction materials, automotive components, and consumer goods is on the rise. This burgeoning demand is expected to drive the consumption of amino resins, particularly in applications such as adhesives and coatings. Market analysts suggest that the growth in these economies could lead to a significant increase in the overall market size for amino resins, as manufacturers seek to capitalize on new opportunities. This trend underscores the potential for expansion in the industry.