Top Industry Leaders in the Purpose Built Backup Appliance Market

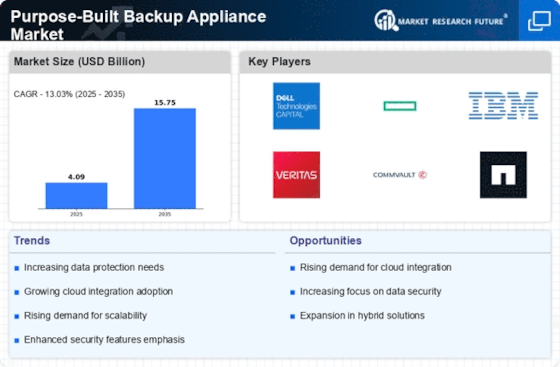

Competitive Landscape of the Purpose-Built Backup Appliance (PBBA) Market

The purpose-built backup appliance (PBBA) market is a vibrant and dynamic arena. Understanding the competitive landscape is crucial for both established players and aspiring entrants. This analysis delves into the strategies of leading brands, key factors influencing market share, the rise of new players, and the overall competitive scenario. This growth is attracting both established players and new entrants, creating a competitive landscape characterized by diverse strategies and evolving trends.

Key Player:

- Dell EMC

- Oracle Corporation

- Axcient Inc.

- Barracuda Network Inc.

- Arcserve LLC

- International Business Machines Corporation

- Hitachi Data Systems Corporation

- Commvault Systems Inc.

- Quantum Corporation

- Hewlett Packard Enterprise Company

Strategies Adopted by Leaders:

- All-in-One Convenience: Veritas Technologies and Veeam Software prioritize pre-configured hardware and software packages, offering ease of deployment and management for small and medium enterprises.

- Scalability and Performance: Dell EMC and NetApp focus on high-performance appliances capable of handling large data volumes, catering to the needs of large enterprises and data centers.

- Cloud Integration: Cohesity and Rubrik seamlessly integrate data backup with cloud storage platforms, capitalizing on the growing trend of cloud-based data protection.

- Cybersecurity Focus: Acronis emphasizes advanced security features like encryption and anti-malware protection, addressing the rising concerns about data breaches and ransomware attacks.

- Subscription Models: Commvault Systems offers flexible subscription plans, ensuring recurring revenue and catering to budget constraints.

Factors for Market Share Analysis:

- Technological Innovation: Companies offering advanced features like deduplication, compression, and data analytics command premium prices and secure market share by optimizing storage utilization and offering valuable insights.

- Integration and Compatibility: Seamless integration with existing IT infrastructure and compatibility with a wide range of operating systems and applications are crucial for market adoption.

- Cybersecurity Features: Robust security measures, compliance with data privacy regulations, and proactive protection against evolving cyber threats are paramount for customer trust and regulatory compliance.

- Cost Competitiveness: Balancing affordability with performance and offering scalable solutions for different data backup needs are essential for winning deals in price-sensitive segments.

- Ease of Use and Management: Intuitive interfaces, automated tasks, and remote management capabilities enhance user experience and reduce operational costs, influencing market share.

New and Emerging Companies:

- Startups like Datos and Spanning: These innovators target niche markets like cloud-native environments and blockchain integration, offering specialized solutions for new data protection challenges.

- Research Institutions and Universities: MIT's Computer Science and Artificial Intelligence Laboratory and Carnegie Mellon University's Storage Laboratory explore novel data protection techniques like holographic storage and self-healing data, paving the way for future disruptions.

- Open-Source Providers: Projects like Zmanda and Bacula offer cost-effective open-source backup solutions, challenging established players with more affordable options.

Industry Developments:

Dell EMC:

- Dec 2023: Launched PowerVault series of backup appliances with scalable storage and cloud integration for mid-sized businesses.

-

Oct 2023:Partnered with leading cloud providers to offer seamless data backup and recovery to the cloud.

Veeam:

- Oct 2023: Announced Kasten by Veeam, a Kubernetes backup and disaster recovery solution for cloud-native applications.

-

Jun 2023:Released V12 of its flagship backup software with enhanced ransomware protection and cloud capabilities.