Top Industry Leaders in the Pumped Hydroelectric Storage Turbines Market

*Disclaimer: List of key companies in no particular order

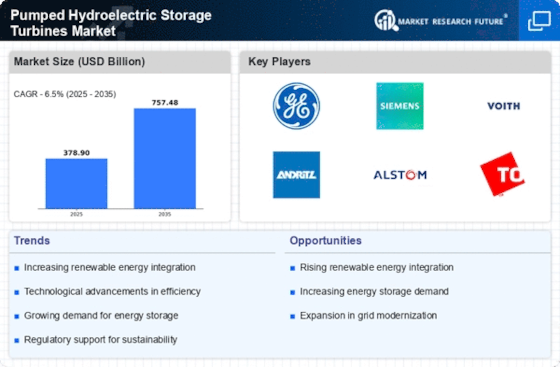

Top listed global companies in the Pumped Hydroelectric Storage Turbines industry are:

Voith GmbH & Co. KGaA (Germany),General Electric(US), Toshiba Corporation (Japan),Mitsubishi Heavy Industries, Ltd. (Japan), NuStreem LLC (US), GUGLER Water Turbines GmbH (Germany), Natel Energy (US), Andritz and Hitachi.

Bridging the Gap by Exploring the Competitive Landscape of the Pumped Hydroelectric Storage Turbines Top Players

The pumped hydroelectric storage (PHS) turbines market is experiencing a resurgence, driven by the rise of renewables and the need for grid stability. This niche market presents both challenges and opportunities for established players and newcomers alike.

Key Players and Strategies:

• Established Giants: Leading the pack are giants like Voith, GE, Toshiba, and Mitsubishi Heavy Industries. These companies leverage their extensive experience, vast installed base, and global reach to maintain sizeable market shares. Voith, for instance, focuses on efficiency improvements and modular solutions, while GE emphasizes digitalization and remote monitoring capabilities.

• Asian Growth Engines: Chinese players like Andritz and Shanghai Hydro have risen rapidly, driven by domestic demand and cost-competitive offerings. They are actively seeking international ventures and partnerships to expand their footprints.

• Emerging Innovators: Smaller companies like NuStreem and Natel Energy are carving niches with innovative designs and niche applications. NuStreem's closed-loop, underwater PHS systems cater to specific geographical constraints, while Natel Energy specializes in compact, modular turbines for smaller projects.

Market Share Analysis:

• Factors Influencing Shares: Analyzing market share in the PHS turbine market requires a multi-pronged approach. Installed capacity, geographical presence, project-specific customizations, and technological advancements all play a role. Additionally, government policies and incentives for renewable energy storage heavily influence regional trends.

• Regional Dynamics: Asia-Pacific currently dominates the market, driven by China's ambitious PHS expansion plans. Europe and North America, with their mature grids and increasing focus on renewables integration, are also key markets. The Middle East and Africa, with their abundant solar and wind resources, represent promising emerging markets.

New and Emerging Trends:

• Hybrid & Symbiotic Concepts: Integrating PHS with other renewable energy sources like solar and wind farms is gaining traction. This allows for efficient energy storage and utilization during peak demand periods.

• Underground and Underwater Solutions: Space constraints and environmental concerns are driving the development of compact, underground or underwater PHS systems. These offer flexibility in location and minimize environmental impact.

• Advanced Materials & Automation: Manufacturers are incorporating advanced materials like composite blades and exploring automation for turbine operation and maintenance. This improves efficiency, reduces downtime, and lowers overall costs.

Competitive Scenario:

• Collaboration & Consolidation: Partnerships and joint ventures between established players and innovators are emerging, fostering knowledge sharing and technological advancements. Consolidation through mergers and acquisitions is also likely, reshaping the competitive landscape.

• Focus on Efficiency & Sustainability: Manufacturers are focusing on improving turbine efficiency, reducing environmental footprint, and developing lifecycle management solutions. This caters to the growing demand for sustainable energy infrastructure.

• Digitalization & Advanced Analytics: Integrating data analytics and machine learning into PHS operations is gaining traction. This enables predictive maintenance, optimizes performance, and enhances grid stability.

The PHS turbines market is poised for significant growth in the coming years. The competitive landscape is evolving, with established players facing challenges from innovative newcomers and regional growth engines. Collaboration, technological advancements, and a focus on sustainability will be key differentiators in this dynamic market. Understanding these trends and factors influencing market share analysis will be crucial for companies to navigate the complexities and capitalize on the opportunities in this promising sector.

Latest Company Updates:

Voith GmbH & Co. KGaA (Germany): June 2023: Voith partners with ANDRITZ Hydro for the rehabilitation of the Markersbach pumped storage power plant in Austria. (Source: Voith press release)

General Electric (US): September 2023: GE Renewable Energy announces a new vertical axis hydro turbine technology specifically designed for pumped storage applications. (Source: GE Renewable Energy press release)

Toshiba Corporation (Japan): October 2023: Toshiba completes development of a high-efficiency, large-capacity pump-turbine for large-scale pumped storage projects. (Source: Toshiba press release)

Mitsubishi Heavy Industries, Ltd. (Japan): November 2023: MHI successfully tests a next-generation, high-efficiency pump-turbine for long-term operation. (Source: MHI press release)

NuStreem LLC (US): December 2023: NuStreem secures funding for the development of its innovative closed-loop pumped hydro technology. (Source: NuStreem press release)