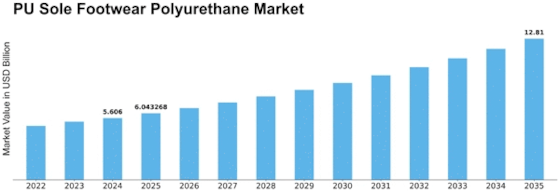

Pu Sole Footwear Polyurethane Size

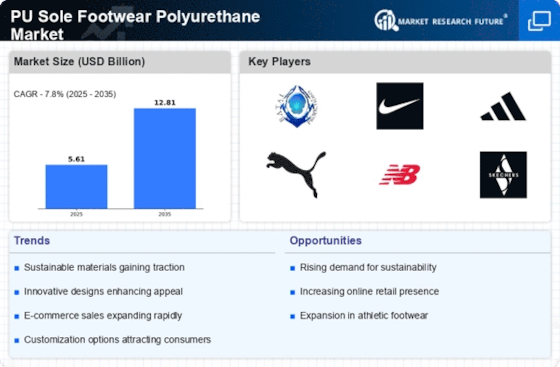

PU Sole Footwear Polyurethane Market Growth Projections and Opportunities

The PU sole footwear polyurethane market is influenced by a myriad of factors that collectively shape its dynamics and growth trajectory. One of the primary market drivers is the ever-evolving consumer preferences and lifestyle choices. As individuals seek comfort, durability, and style in their footwear, the demand for PU sole footwear continues to rise. Moreover, the versatility of polyurethane material allows for the creation of footwear suitable for various occasions, from casual wear to athletic activities, further expanding its market appeal.

Economic factors also play a significant role in shaping the PU sole footwear polyurethane market. Fluctuations in disposable income levels, consumer spending patterns, and overall economic conditions directly impact the purchasing power of consumers. During periods of economic prosperity, consumers are more inclined to invest in high-quality footwear, driving demand for PU sole products. Conversely, economic downturns may lead to reduced consumer spending on non-essential items, affecting the market demand.

Technological advancements in manufacturing processes and materials contribute to the growth and innovation within the PU sole footwear polyurethane market. Manufacturers continually strive to enhance product performance, comfort, and sustainability through the adoption of advanced technologies and materials. This includes the development of eco-friendly polyurethane formulations and production methods, aligning with growing consumer awareness of environmental sustainability.

Supply chain dynamics also influence the PU sole footwear polyurethane market. Factors such as raw material availability, production costs, and transportation logistics impact the overall competitiveness of market players. Fluctuations in raw material prices, particularly those of petrochemicals used in polyurethane production, can directly affect manufacturing costs and product pricing. Additionally, geopolitical factors and trade policies may introduce uncertainties in the supply chain, leading to market disruptions.

Consumer demographics and lifestyle trends are essential considerations for market players in the PU sole footwear polyurethane industry. Shifts in demographics, such as population aging or urbanization trends, can influence consumer preferences and demand patterns. Moreover, changing lifestyle trends, such as the growing emphasis on health and wellness, influence the demand for comfortable and supportive footwear, driving the adoption of PU sole products.

Environmental regulations and sustainability initiatives also shape the PU sole footwear polyurethane market landscape. As governments worldwide introduce stricter regulations and initiatives to reduce environmental impact, manufacturers are compelled to adopt sustainable practices throughout the product lifecycle. This includes the use of recycled materials, reducing carbon emissions, and implementing eco-friendly production processes. Companies that demonstrate a commitment to sustainability not only meet regulatory requirements but also appeal to environmentally conscious consumers, gaining a competitive edge in the market.

Competitive dynamics within the PU sole footwear polyurethane market are driven by factors such as branding, product differentiation, and market positioning. Established brands leverage their reputation and marketing strategies to maintain market share and customer loyalty. Meanwhile, emerging players focus on innovation and unique selling propositions to carve out a niche in the market. Strategic partnerships, collaborations, and mergers and acquisitions also shape the competitive landscape, allowing companies to expand their product offerings and market reach.

Leave a Comment