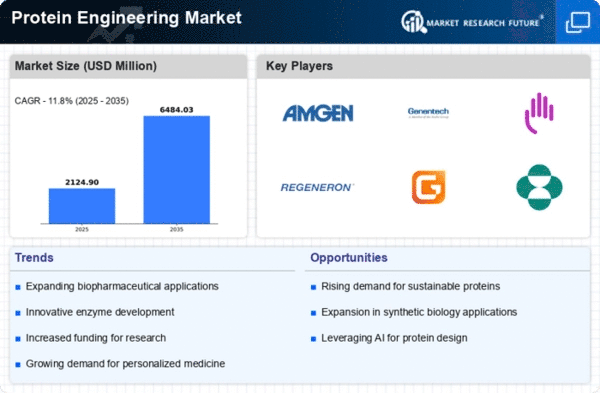

Market Growth Projections

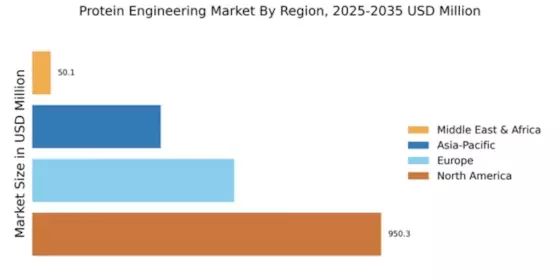

The Global Protein Engineering Market Industry is projected to experience substantial growth in the coming years. With a market value of 1.9 USD Billion in 2024, it is anticipated to reach 6.48 USD Billion by 2035, reflecting a robust CAGR of 11.81% from 2025 to 2035. This growth trajectory is indicative of the increasing importance of protein engineering across various sectors, including pharmaceuticals, agriculture, and industrial applications. The market's expansion is likely to be driven by ongoing technological advancements, rising demand for biopharmaceuticals, and the growing recognition of engineered proteins' potential to address complex challenges in health and industry.

Regulatory Support and Frameworks

Regulatory support is an essential factor influencing the Global Protein Engineering Market Industry. Governments worldwide are establishing frameworks that facilitate the approval and commercialization of engineered proteins, particularly in the biopharmaceutical sector. These regulations aim to ensure safety and efficacy while promoting innovation. The establishment of clear guidelines encourages investment and research, as companies are more likely to engage in protein engineering initiatives when regulatory pathways are well-defined. This supportive environment is likely to enhance the market's growth, as it fosters collaboration between regulatory bodies and industry stakeholders, ultimately benefiting public health.

Rising Demand for Biopharmaceuticals

The Global Protein Engineering Market Industry is experiencing a notable surge in demand for biopharmaceuticals, driven by advancements in personalized medicine and targeted therapies. As of 2024, the market is valued at approximately 1.9 USD Billion, reflecting the increasing reliance on engineered proteins for drug development. This trend is expected to continue, with projections indicating a market growth to 6.48 USD Billion by 2035. The compound annual growth rate (CAGR) of 11.81% from 2025 to 2035 underscores the potential of protein engineering in producing innovative therapeutics that cater to specific patient needs.

Growing Applications in Industrial Biotechnology

The Global Protein Engineering Market Industry is witnessing an expansion in applications beyond healthcare, particularly in industrial biotechnology. Engineered proteins are increasingly utilized in various sectors, including agriculture, food production, and environmental management. For example, enzymes developed through protein engineering are employed in biofuels and bioremediation processes, showcasing their versatility. This diversification of applications is expected to contribute to the market's growth trajectory, as industries seek sustainable and efficient solutions. The ongoing exploration of protein engineering in industrial contexts suggests a promising future for the market, with potential for significant economic impact.

Increasing Investment in Research and Development

Investment in research and development is a critical driver for the Global Protein Engineering Market Industry. Governments and private entities are allocating substantial resources to explore the therapeutic applications of engineered proteins. This trend is evident in various initiatives aimed at fostering innovation in biotechnology. For instance, funding programs targeting protein engineering research have been established, leading to breakthroughs in drug discovery and development. The anticipated growth of the market from 1.9 USD Billion in 2024 to 6.48 USD Billion by 2035 highlights the importance of sustained investment in R&D, which is essential for advancing the field and addressing unmet medical needs.

Technological Advancements in Protein Engineering

Technological innovations play a pivotal role in shaping the Global Protein Engineering Market Industry. The advent of high-throughput screening and computational modeling techniques has revolutionized the way proteins are engineered. These advancements facilitate the rapid identification and optimization of protein structures, enhancing their efficacy and stability. As a result, companies are increasingly investing in research and development to harness these technologies, thereby driving market growth. The integration of artificial intelligence and machine learning into protein design processes further amplifies the potential for creating novel proteins with desirable characteristics, positioning the industry for sustained expansion.