Market Trends

Key Emerging Trends in the Protective Coatings Market

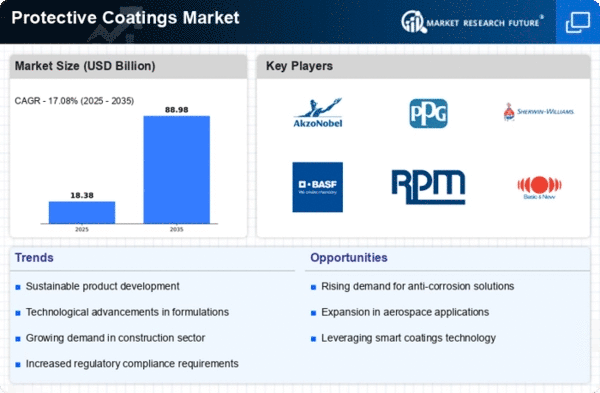

The Protective Coatings market is undergoing the process of changing due to influencing factors such as industry demand and application changes. Protective coatings are the means for the prevention of corrosion, abrasion and environment damage which are temporarily applied to adhere to the substrates. There is escalating inrush of wear-resistant and protective coatings in infrastructure sector. Sustaining coatings based on greater life span and more weather resistance are on the increase, and streetlamps, power poles and building structures enjoy greater protection from environmental influences. The aging infrastructure needs projects that are greener and financially sound and engineers emerge as the driving force behind such solutions in the construction industry.

As well as providing coating for oil and gas businesses, it adds to this demand for protective coatings. Protective coatings become needed of field installations since they are exposed to corrosion products and AC environments. The company shifts its focus on corrosion resistant (“highly chemical resistant) coatings. With a similarity to the reliability and efficient operations that the oil and gas sector advocates for, the storyline follows this way as well.

Sustainable environmental practices are gaining more significance in the context of the coatings used to safeguard surfaces. Currently, people do not only face the issue with coating developement however they also are inclined toward low VOC and eco- friendly products. On an international level, manufacturers are working to make products with less impact on the environment by developing eco friendly protection housewares. This change indicates the seriousness of protecting coatings from a negative environmental improt in this industry. The following table shows the characteristics and responsibilities aligned with specific job roles within a rental property management ventures

Further, an automotive and aerospace sector informs developments of this sort in the protective coatings industry. These specialized protective coatings protect against corrosion, ultraviolet light deterioration, and prolong life of the vehicle. In vehicle and aerospace design we shift to using lighter materials, so that coatings of a higher protective abilities without reduction in weight or performance rate become a premium.

Strategic cooperation on protective coatings is also becoming vital. Companies join together and cooperate on the development of new formulations, relevant applications, and technological breakthroughs. Forming the coalition deal with such sectors, the coalition partners try to tackle the problems of infrastructure, oil & gas, automotive and aerospace. Partnership means integrating and modernizing protective coatings technology to fit industry specifications.

Another impact of technological advances on the trends of protective coatings industry is that it forms the entire sphere of the protective coatings industry. To enhance the performance wet protective coating companies and researchers are testing new formulas and also utilizing nanotechnology. Self-healing, anti-microbial, and adhesion-improving coatings belong to advances in aerospace and automotive materials. These innovative technologies offer market the flexibility and effectiveness that can be catered for an oil and water resistant coatings applications.

Leave a Comment