Economic Fluctuations

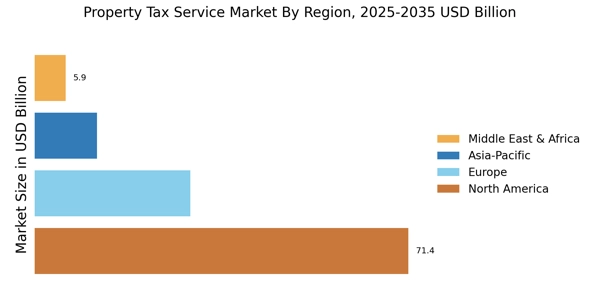

The Property Tax Service Market is influenced by economic fluctuations that impact property ownership and investment decisions. Economic downturns can lead to decreased property values, prompting property owners to seek tax relief and reassessments. Conversely, during periods of economic growth, property values tend to rise, increasing tax liabilities. Recent economic indicators suggest a mixed outlook, with some regions experiencing growth while others face challenges. This variability creates a dynamic environment for property tax services, as they must adapt to changing market conditions and client needs. The ability to navigate these economic fluctuations is crucial for property tax service providers to effectively support their clients.

Complex Tax Regulations

The Property Tax Service Market is significantly influenced by the complexity of tax regulations that vary by jurisdiction. As local governments implement new tax laws and adjust existing ones, property owners often find themselves overwhelmed by the intricacies of compliance. This complexity creates a substantial demand for property tax services, as professionals can provide guidance on navigating these regulations. Recent studies indicate that nearly 60% of property owners are unaware of the specific tax exemptions available to them, highlighting the potential for property tax services to educate clients and optimize their tax positions. As regulations continue to evolve, the need for expert advice in the Property Tax Service Market is likely to increase.

Increasing Property Values

The Property Tax Service Market is experiencing a notable increase in property values across various regions. As real estate markets recover and expand, property assessments are likely to rise, leading to higher tax liabilities for property owners. This trend necessitates the need for property tax services to assist clients in navigating the complexities of tax assessments and appeals. According to recent data, property values have surged by approximately 5 to 10% in many urban areas, prompting property owners to seek professional assistance to ensure fair taxation. The demand for property tax services is expected to grow as property owners become more aware of their rights and the potential for tax savings through effective representation.

Technological Advancements

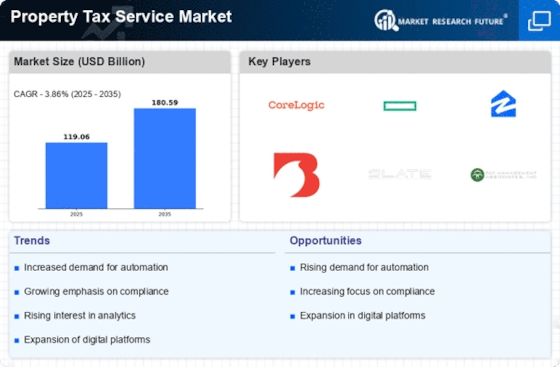

The Property Tax Service Market is being transformed by technological advancements that streamline the assessment and appeal processes. Innovations such as automated valuation models and data analytics tools are enabling property tax service providers to deliver more accurate assessments and efficient services. These technologies not only enhance operational efficiency but also improve client satisfaction by providing timely and precise information. Recent market analysis indicates that firms utilizing advanced technology have seen a 20% increase in client retention rates. As technology continues to evolve, property tax service providers are likely to adopt these tools to remain competitive and meet the growing demands of property owners.

Rising Awareness of Tax Appeals

The Property Tax Service Market is witnessing a growing awareness among property owners regarding their rights to appeal tax assessments. As property values rise, many owners are discovering discrepancies in their assessments, leading to an increased interest in challenging these valuations. Data suggests that the number of tax appeals has risen by approximately 15% in the past year, indicating a shift in property owner behavior. This trend presents a significant opportunity for property tax service providers to offer their expertise in the appeals process, helping clients potentially reduce their tax burdens. The increasing awareness of tax appeal rights is likely to drive demand for property tax services in the coming years.