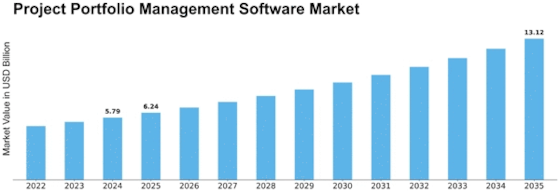

Project Portfolio Management Software Size

Project Portfolio Management Software Market Growth Projections and Opportunities

The Project Portfolio Management (PPM) Software industry is growing and evolving due to several causes. PPM software helps firms efficiently manage projects, optimizing resource allocation and strategic alignment with company goals. Technological advances, company demands, and competition affect PPM software market dynamics.

PPM Software sales are driven by the growing complexity of projects across sectors. As projects become increasingly complex, sophisticated systems that can manage numerous projects simultaneously and provide a complete project portfolio view are needed. PPM software helps firms manage contemporary projects by providing project planning, resource management, and real-time tracking.

The unrelenting speed of technical progress also shapes market dynamics. Advanced project management tools are prioritized when firms undergo digital transformation. Artificial intelligence, machine learning, and automation are used by PPM software suppliers to give customers with intelligent insights, predictive analytics, and optimized operations. This technological advancement enhances project management and boosts the PPM Software industry.

Global company activities also affect PPM Software market dynamics. With companies operating in multiple geographies, PPM solutions that enable team cooperation and communication are needed. Cloud-based PPM solutions that allow remote access, real-time updates, and seamless collaboration have become popular, addressing the scattered nature of modern organizations.

The growing emphasis on data-driven decision-making shapes PPM Software market dynamics. PPM solutions aid project planning and execution and give data-driven insights. Organizations are using PPM software to collect and analyze project data to make choices, spot patterns, and reduce risks. The potential of PPM software to turn raw project data into usable insight drives its growth across industries.

PPM Software market dynamics are also shaped by competition. With more suppliers joining the market, competition for feature-rich and user-friendly solutions is fierce. Vendors are tailoring their products to IT, healthcare, construction, and other industries to stand out. This rivalry spurs innovation as companies compete on functionality, performance, and user experience.

Regulatory and compliance requirements affect market dynamics, notably in healthcare and finance, where standards are crucial. PPM software that meets regulatory criteria is popular. Making sure their products match these criteria gives them a competitive edge.

Leave a Comment