Rising Consumer Awareness

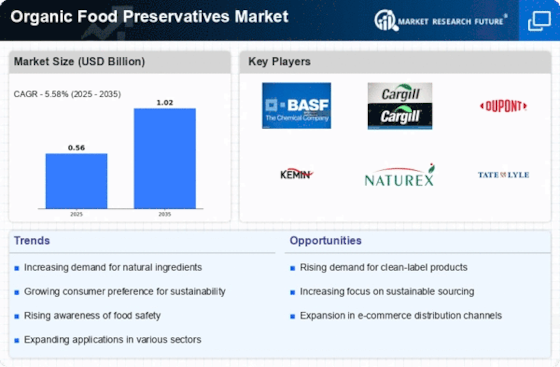

The Organic Food Preservatives Market is experiencing a notable surge in consumer awareness regarding the benefits of organic products. As individuals become more informed about the potential health risks associated with synthetic preservatives, there is a marked shift towards organic alternatives. This trend is reflected in market data, which indicates that the organic food sector has seen a compound annual growth rate of approximately 10% over the past few years. Consumers are increasingly seeking transparency in food labeling, which further propels the demand for organic preservatives. This heightened awareness not only influences purchasing decisions but also encourages manufacturers to innovate and expand their organic product lines, thereby driving growth in the Organic Food Preservatives Market.

Increased Focus on Food Safety

Food safety remains a paramount concern for consumers and manufacturers alike, driving the Organic Food Preservatives Market. The rising incidence of foodborne illnesses has heightened awareness regarding the importance of safe food preservation methods. Organic preservatives are perceived as safer alternatives to their synthetic counterparts, which may contain harmful chemicals. This perception is supported by data indicating that the organic food market is expected to reach a valuation of over 300 billion dollars by 2025, underscoring the growing emphasis on food safety. As consumers prioritize health and safety in their food choices, the demand for organic preservatives is likely to increase, further propelling the Organic Food Preservatives Market.

Shift Towards Natural Ingredients

There is a discernible shift towards natural ingredients within the food industry, which significantly impacts the Organic Food Preservatives Market. Consumers are increasingly favoring products that contain natural rather than synthetic components, leading to a growing demand for organic preservatives derived from plant sources. Market analysis suggests that the natural preservatives segment is projected to grow at a rate of 8% annually, reflecting the changing preferences of health-conscious consumers. This trend is not only reshaping product formulations but also encouraging manufacturers to explore innovative extraction methods for organic preservatives. Consequently, the Organic Food Preservatives Market is poised for expansion as it aligns with consumer desires for cleaner, more natural food options.

Innovation in Preservation Techniques

Innovation plays a critical role in the evolution of the Organic Food Preservatives Market. Advances in preservation techniques, such as high-pressure processing and natural fermentation, are enabling manufacturers to enhance the shelf life of organic products without compromising their quality. These innovations not only meet consumer demands for longer-lasting products but also align with the growing trend towards sustainability. Market Research Future indicates that the adoption of innovative preservation methods could lead to a 15% reduction in food waste, a significant concern in the food industry. As companies continue to invest in research and development, the Organic Food Preservatives Market is likely to benefit from new technologies that improve product efficacy and consumer appeal.

Regulatory Support for Organic Products

The Organic Food Preservatives Market benefits significantly from supportive regulatory frameworks that promote organic farming and food production. Various governments have implemented policies aimed at encouraging organic agriculture, which includes the use of organic preservatives. For instance, regulations that provide certification for organic products help to build consumer trust and facilitate market entry for organic food manufacturers. This regulatory support is crucial, as it not only legitimizes organic products but also enhances their visibility in the marketplace. As a result, the Organic Food Preservatives Market is likely to witness increased investment and innovation, further solidifying its position in the food sector.