Market Share

Process Orchestration Market Share Analysis

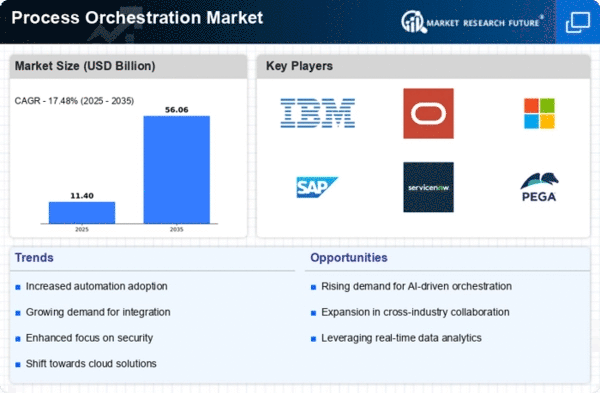

There are significant trends in the market as organizations look to streamline and optimize their business processes for improved efficiency and agility. One trend that stands out is the increased usage of cloud-based process orchestration solutions. It is, therefore, expected that with an increase in the adoption of cloud computing by businesses due to its commercial viability, scalability, and freedom, there will be a higher demand for cloud-based orchestration platforms. Additionally, AI/ML incorporation is among the key drivers shaping the future of the Process Orchestration Market. This encourages many groups to use these sophisticated techniques to enrich the intelligence capability within their respective process orchestrations. The ability of AI/ML-enabled process orchestration platforms to learn from historical data, predict potential bottlenecks or inefficiencies in workflows and automate decisions results in much more adaptive and smarter business processes. In the Process Orchestration market, interconnectivity is a must-have attribute across diversified systems and applications. Companies must find ways to make their solutions integrate smoothly with a range of software applications, databases, and APIs. The focus has been on hyperautomation, leading to enhancements in process orchestration solutions. This involves the use of sophisticated technologies such as robotic process automation (RPA) in carrying out quite many business processes. Process orchestration plays a central role in coordinating and managing these automated tasks across different departments and systems. The adoption of low-code and no-code platforms by businesses for process orchestration that allows non-technical users to design workflows with minimal coding requirements is increasing drastically. Business user-driven creation of processes through the democratization of process orchestration reduces reliance on IT resources, thereby resulting in a faster innovation pace. They are increasingly embracing low-code or no-code development options so that people without technical programming skills can design & implement workflows, thus reducing dependency on IT departments over time as well as accelerating the pace at which new ideas come about. Security and compliance are becoming integral aspects of process orchestration solutions. Consequently, organizations tend to prioritize orchestration platforms that have greater security features while complying with specified control standards, considering the complexity of business practices and an increased emphasis on data privacy regulation today. Event-driven architecture is one factor shaping the Process Orchestration Market as it enables real-time responses by firms to events or triggers that occur within business processes. Process orchestration solutions are evolving through continuous improvement and optimization. Businesses require platforms that give them analytics regarding how orchestrated processes are performing; hence, they prefer those that incorporate analysis capabilities for performance tracking purposes while selecting a platform for orchestrating their business activities. Being data-driven lets organizations identify bottlenecks, track key performance indicators (KPIs), & improve these procedures progressively towards achieving better performance levels.

Leave a Comment