Privacy Management Software Size

Market Size Snapshot

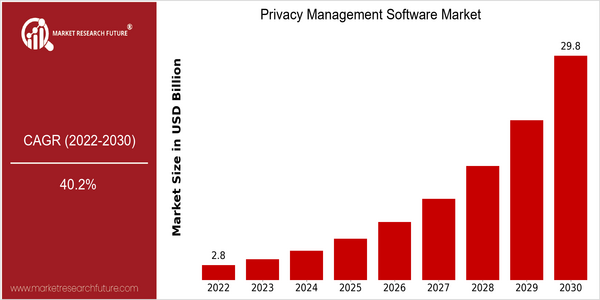

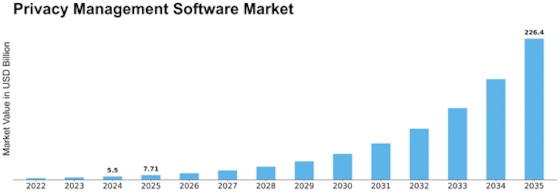

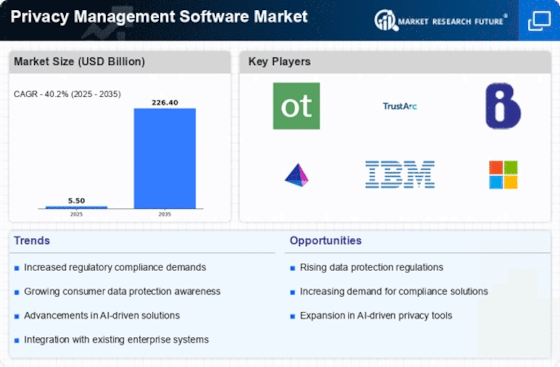

| Year | Value |

|---|---|

| 2022 | USD 2.8 Billion |

| 2030 | USD 29.8 Billion |

| CAGR (2022-2030) | 40.2 % |

Note – Market size depicts the revenue generated over the financial year

The market for privacy management software is expected to expand from $2.8 billion in 2022 to $29 billion in 2023, with a CAGR of 40.2%. This growth reflects the rising demand for privacy management solutions as the need for data protection and compliance with increasingly strict regulations increases. The digital transformation and the increase in data breaches have led to greater awareness of the importance of data protection and have forced companies to invest in comprehensive software solutions that ensure compliance with the GDPR and CCPA. The rise in cyber threats, the growing complexity of data privacy regulations, and the increased use of cloud-based services are the main growth drivers for the market. The capabilities of privacy management solutions are also enhanced by technological advancements, such as artificial intelligence and machine learning, which help organizations automate compliance processes and enhance data governance. Strategic initiatives by leading vendors in this market, such as OneTrust, TrustArc, and BigID, are strengthening their market positions and addressing evolving customer requirements. These developments are indicative of the dynamic market growth.

Regional Market Size

Regional Deep Dive

The market for privacy management software is experiencing a strong growth in various regions, driven by the growing data privacy concerns, the increasing stringent regulations, and the growing need for organizations to manage personal data effectively. In North America, the market is mature, with a high adoption of privacy management solutions, largely due to the presence of advanced technology companies and a pro-active regulatory environment. In Europe, driven by the General Data Protection Regulation and other local regulations, the market is experiencing strong growth, while Asia-Pacific is emerging as a key market as organizations are increasingly prioritizing data protection in the context of digital transformation. The Middle East and Africa are slowly adopting privacy management solutions, influenced by the evolving regulatory environment and the growing awareness of data privacy issues. Latin America is also experiencing a growing demand for privacy management solutions, driven by new data protection laws and a growing focus on compliance.

Europe

- The implementation of the GDPR has significantly influenced the privacy management software market, leading to increased demand for compliance solutions among businesses across the EU.

- Organizations such as the European Data Protection Board (EDPB) are actively shaping the market by providing guidelines and frameworks that necessitate the use of robust privacy management tools.

Asia Pacific

- Countries like Japan and South Korea are enhancing their data protection laws, which is driving the adoption of privacy management software among local businesses seeking to comply with new regulations.

- The rise of digital services and e-commerce in the region has led to a heightened focus on data privacy, with companies like Alibaba and Tencent investing in privacy management solutions to protect user data.

Latin America

- Brazil's General Data Protection Law (LGPD) has catalyzed the demand for privacy management software, as companies scramble to align their practices with the new legal requirements.

- Local startups are emerging in the privacy management space, leveraging innovative technologies to provide tailored solutions for businesses navigating the complexities of data protection.

North America

- The California Consumer Privacy Act (CCPA) has set a precedent for privacy regulations in the U.S., prompting many companies to invest in privacy management software to ensure compliance and avoid hefty fines.

- Major tech companies like Microsoft and IBM are leading the charge in developing innovative privacy management solutions, integrating AI and machine learning to enhance data protection capabilities.

Middle East And Africa

- The introduction of the Personal Data Protection Law in the UAE is a significant regulatory development that is encouraging businesses to adopt privacy management software to ensure compliance.

- Organizations such as the African Union are promoting data protection initiatives, which are fostering a growing awareness of privacy management needs across the continent.

Did You Know?

“As of 2023, over 80% of organizations globally have reported that they are investing in privacy management software to comply with various data protection regulations.” — International Association of Privacy Professionals (IAPP)

Segmental Market Size

The Privacy Management Software segment is an important part of the overall market and is experiencing strong growth, primarily due to regulatory and consumer demand. The introduction of strict regulations such as the GDPR and CCPA is driving the segment’s growth. Furthermore, heightened awareness of the importance of privacy is pushing companies to use privacy management as a differentiator. The current trend is towards the transition from the pilot phase to mass implementation, with industry leaders OneTrust and TrustArc establishing the industry standard. Applications include compliance management, risk assessment and data subject access, especially in the finance and health care industries where data sensitivity is paramount. The rise in remote work and cyber threats are also driving the demand for privacy solutions. Artificial intelligence and machine learning are driving the evolution of the segment, enabling more efficient data handling and risk mitigation strategies.

Future Outlook

The privacy management system market will grow from $2.8 billion to $29.8 billion by 2023, with a CAGR of 40.2%. This explosive growth is driven by the escalation of data privacy regulations such as the European Union’s General Data Protection Regulation and California’s Californian Consumers’ Privacy Act, which forces companies to adopt a comprehensive privacy management system. This is also the result of companies placing more importance on compliance and trust. By 2023, the penetration of privacy management system is expected to reach 60% of companies from the current 15%, which represents a significant shift from reactive to proactive privacy governance. Machine learning and artificial intelligence will enhance the capabilities of privacy management systems and help companies automate the compliance process and strengthen the data protection measure. Also, the remote work and digital transformation have made companies more concerned about data security, thus increasing the demand for privacy management systems. The integration of privacy by design and the increasing emphasis on the right of the individual to the data will shape the market competition and drive innovation and differentiation among market players. Moreover, as companies continue to recognize the strategic value of privacy management, the market will evolve into a critical part of the overall business strategy and ensure the long-term resilience to the evolving data privacy challenges.

Leave a Comment