Market Trends

Key Emerging Trends in the Primary Osteoarthritis Market

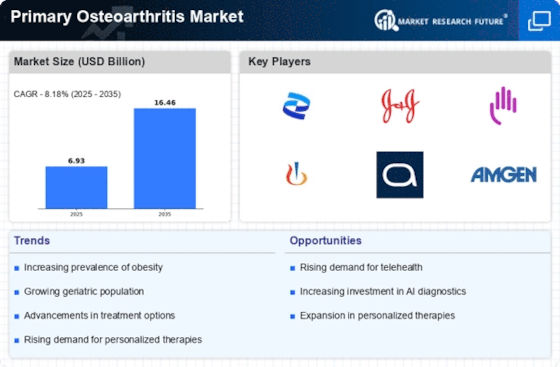

Market trends related to primary osteoarthritis reflect a dynamic landscape resulting from several factors including aging populations, lifestyle changes as well as advancements in medical treatments. One major trend is increased incidence of primary OA due mainly to aging population worldwide. This has therefore resulted into increased patients’ number who look forward early diagnosis procedures through effective management practices.

Concurrently with the growing incidence, treatment of primary OA is seen to change towards a holistic and multimodal approach. Although pharmaceutical interventions such as analgesics and anti-inflammatory drugs are still vital, there is an increasing awareness on the significance of non-pharmacologic alternatives. Within the context of comprehensive osteoarthritis management strategy, physical therapy, lifestyle adjustments, weight control and exercise programs have been given priority in the recent past as it cures both symptoms and help in stopping further degeneration.

Additionally, the market has witnessed pharmaceutical advancements targeting the pathogenesis of OA. Research initiatives are currently aimed at developing disease modifying drugs that can slow or halt OA progression thereby giving patients more than mere symptom alleviation. The exploration of novel therapeutic agents including techniques for regenerative medicine like stem cell therapy signifies a shift from traditional options toward new treatment modalities.

Moreover there has been growing attention to personalized and precision medicine for primary OA. As our understanding of genetic and molecular factors underlying OA susceptibility and progression expands so does the demand for tailored treatments strategies designed for individual patients. Biomarker discovery as well as genetic profiling paves way for targeted therapies making it possible to manage primary OA more effectively personalized approaches.

The adoption of digital health interventions for managing OA also plays a part in market dynamics. Mobile apps, wearable tech and telehealth channels are being employed to increase patients’ involvement in care, assess symptoms and enable remote OA management support. This is important since it improves the accessibility of healthcare services especially to individuals who cannot move around freely or reside in far areas.

However, issues persist in the primary OA market. The problem of accessing effective therapies remains at large especially in regions with different healthcare infrastructure. Furthermore, concerns have also arisen about affordability and sustainability of all-inclusive OA care because of economic burden caused by medication expenses, physiotherapy fees and surgical procedures.

Leave a Comment