Market Analysis

In-depth Analysis of Predictive Disease Analytics Market Industry Landscape

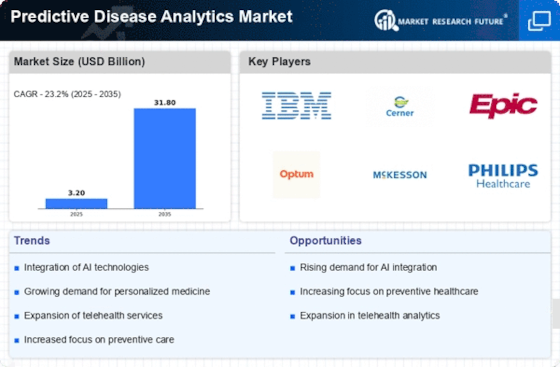

The global predictive disease analytics market is set to reach US$ 13.7 BN by 2032, at a 23.20% CAGR between years 2023-2032. The predictive disease analytics market stands at the nexus of healthcare and technology, amidst a vibrant environment constantly interacting with several key factors driving demand, innovation, and uptake. One of the major reasons is increasing prevalence rates for chronic diseases across the globe. Although the prevalence of diseases like diabetes, cardiovascular ailments and cancer keeps on increasing so does the need for more elaborate technologies in predicting or preventing these illnesses. This demand provides the background for development and transformation of predictive disease analytics market. Technological progress is arguably a pillar of market dynamics. The continuing advancements in data analytics, artificial intelligence and machine learning play a vital role to perfect the predictive disease analytics solutions. The market reacts with sophisticated tools able to not only forecast disease trends but also provide actionable personal insights and refine healthcare interventions. These innovations also help to develop a competitive environment in which companies seek ways for leading technological capacity. Regulatory factors are an integral part of market dynamics. Hospitals operate under tough regulation to ensure patient safety, data privacy and ethical use of predictive analytics. Regulatory compliance then helps to shape the strategy of market participants. The strong regulatory structure increases the reliability of predictable disease analytics solutions, leading to confidence in healthcare infrastructure. The market dynamics are influenced by economic factors such as healthcare expenditure and reimbursement policies. Predictive disease analytics solutions cost-effectiveness is the main factor that should be considered for adoption. Market participants steer these economic factors by creating deliverables that do not just aim to enhance patient outcomes but also provide efficiency gains while being instrumental in cost reduction for healthcare delivery. The dynamics of the predictive disease analytics market are further attracted from globalization and collaborative efforts in healthcare. International research, development and data-sharing partnerships serve to create an interdependent global market where insights or solutions are not limited by geography. This globalization improves the expertise sharing that increases availability of predictive disease analytics solutions and leads to a homogenized approach towards provision. Demographic changes, especially the aging population, play a critical role in market dynamics. Considering the increasing cases of age-related diseases, there is a high demand for predictive analytics that would help in fine tuning health care interventions to certain population groups. The market in turn provides solutions that provide the specific needs of older population and other special health situations.

Leave a Comment