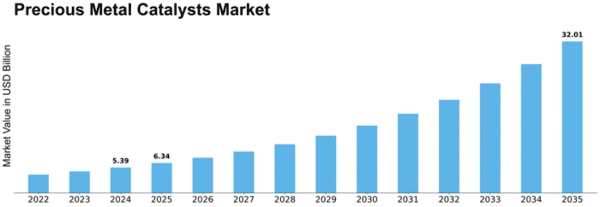

Precious Metal Catalysts Size

Precious Metal Catalysts Market Growth Projections and Opportunities

The Precious Metal Catalysts Market is significantly influenced by various market factors that play a crucial role in shaping its dynamics. One of the primary factors driving the market is the growing demand for precious metal catalysts across diverse industries. These catalysts, often based on metals like platinum, palladium, and rhodium, are essential for various chemical processes, including catalytic converters in automotive applications, petroleum refining, and pharmaceutical manufacturing.

The automotive industry stands out as a major market driver. With stringent emission regulations worldwide, the demand for catalytic converters, which utilize precious metal catalysts, has soared. Governments globally are imposing stricter emission standards to curb air pollution, leading to increased adoption of catalytic converters in vehicles. This surge in demand directly impacts the Precious Metal Catalysts Market, driving its growth.

Another significant market factor is the rise in environmental concerns and the focus on sustainable practices. Precious metal catalysts play a vital role in promoting green and sustainable technologies. Industries are increasingly shifting towards cleaner production processes that minimize environmental impact. Precious metal catalysts enable these industries to adhere to eco-friendly practices, further boosting their demand in the market.

The economic landscape also plays a pivotal role in shaping the Precious Metal Catalysts Market. Fluctuations in global economies can impact the production and consumption patterns of various industries. For instance, during economic downturns, there might be a temporary decline in automotive production, affecting the demand for precious metal catalysts. On the flip side, economic recoveries often lead to increased industrial activities, positively influencing the market.

Moreover, advancements in technology contribute significantly to the growth of the Precious Metal Catalysts Market. Ongoing research and development efforts are focused on enhancing the efficiency and effectiveness of catalysts. Innovations in catalyst design and manufacturing processes contribute to improved catalytic performance, making these catalysts more attractive to industries. As technology evolves, it opens up new applications for precious metal catalysts, expanding their market reach.

The geopolitical landscape also plays a role in shaping the Precious Metal Catalysts Market. The availability and accessibility of raw materials, especially precious metals like platinum and palladium, can be influenced by geopolitical factors. Trade tensions, mining regulations, and geopolitical conflicts can impact the supply chain of these metals, leading to fluctuations in the market.

Regulatory policies and standards are crucial market factors for precious metal catalysts. Governments worldwide are implementing regulations to control emissions and promote sustainable practices. Compliance with these regulations is driving industries to adopt advanced catalytic technologies, thereby boosting the demand for precious metal catalysts. Additionally, stringent quality standards and certifications further influence the market, ensuring that catalysts meet specific performance and environmental criteria.

Market competition is another key factor shaping the Precious Metal Catalysts Market. The presence of numerous manufacturers and suppliers intensifies competition. Companies strive to differentiate themselves through product innovation, quality, and cost-effectiveness. This competitive landscape can impact pricing strategies, research and development investments, and overall market dynamics.

Leave a Comment