Top Industry Leaders in the Powered Agriculture Equipment Market

*Disclaimer: List of key companies in no particular order

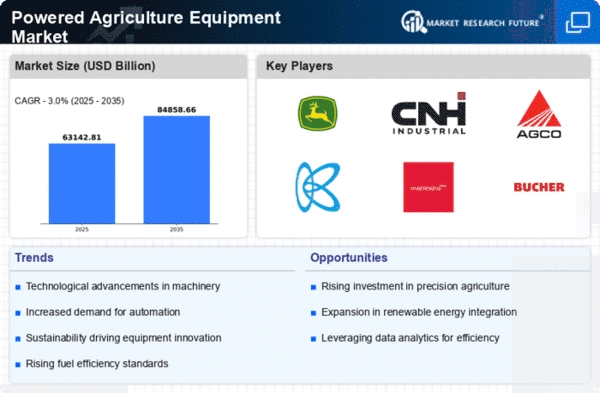

Top listed global companies in the industry are:

- GCO Corporation (U.S.)

- John Deere & Co. (U.S.)

- Mahindra & Mahindra Ltd (India)

- CNH Industrial (U.K)

- Kubota Corporation (Japan)

- CLAAS Group (Germany)

- Alamo Group Inc. (U.S.)

- Escorts Group (India)

- Iseki & Co. Ltd (Japan)

- SDF S.P.A. (Italy), and others.

Cultivating Profits: Navigating the Powered Agriculture Equipment Market

The global powered agriculture equipment market is a fertile ground for competition. Understanding the strategies driving this growth, the factors influencing market share, and emerging trends is crucial for reaping success in this essential agricultural segment.

Key Players and their Strategies:

- Global Titans: Giants like Deere & Company and CNH Industrial leverage their extensive product portfolios, global reach, and brand recognition to command a significant market share. Deere offers diverse solutions across various farm sizes and crops, while CNH Industrial excels in high-horsepower tractors and specialized equipment.

- Regional Champions: Companies like Shandong Lingong Machinery Group and Kubota Corporation dominate specific geographies by tailoring solutions to regional regulations and farm sizes. Shandong Lingong caters to China's large-scale farms with cost-effective tractors, while Kubota excels in smaller, compact equipment for Japan's rice paddies.

- Technology Trailblazers: Startups like AgJunction and Blue River Technology disrupt the market with innovative approaches. AgJunction focuses on precision agriculture solutions with data-driven insights, while Blue River Technology pushes the boundaries of autonomous farm equipment.

Factors for Market Share Analysis:

- Product Breadth and Depth: Offering a wide range of equipment for diverse applications (tractors, harvesters, sprayers) and farm sizes expands market reach and attracts varied customer segments.

- Technological Innovation: Integrating advanced features like precision guidance, automation, and data connectivity attracts farmers seeking increased efficiency, yield optimization, and reduced labor costs. AgJunction's yield monitoring systems exemplify this.

- Cost-Effectiveness and ROI: Balancing advanced features with affordability is crucial, especially in price-sensitive regions. Shandong Lingong's cost-effective tractors have secured a strong foothold in emerging markets.

- After-Sales Service and Support: Offering comprehensive service networks, readily available spare parts, and technical assistance fosters customer loyalty and market penetration. Deere excels in this area with its extensive dealer network.

Emerging Trends and Company Strategies:

- Precision Agriculture Focus: Integrating sensors, data analytics, and automation into equipment enables precise application of inputs, resource optimization, and improved yields. Blue River Technology's autonomous weeding robots exemplify this trend.

- Electrification and Sustainability: Developing electric and hybrid-powered equipment reduces emissions, fuel costs, and environmental impact. CNH Industrial's methane-powered tractors illustrate this commitment.

- Focus on Smart Farming: Offering cloud-based platforms and digital tools for farm management, data analysis, and predictive maintenance attracts tech-savvy farmers and larger agribusinesses. AgJunction's data management platform exemplifies this approach.

- Renting and Sharing Economy: Offering equipment rental and sharing models caters to smaller farms and reduces upfront investment costs. Startups like Hello Tractor are disrupting this space.

Overall Competitive Scenario:

The powered agriculture equipment market presents a dynamic landscape where established players face challenges from regional specialists and technology-driven startups. Success hinges on offering diverse product portfolios, embracing technological advancements, prioritizing sustainability and efficiency, and adapting to evolving farming practices. Companies demonstrating agility, cost-effectiveness, and a commitment to customer needs hold a strong position in this fertile marketplace.

Latest Company Updates:

August 2023

New Holland Agriculture is planning to launch the T4 Electric Power, a new all-electric utility tractor with autonomous features in 2024. This innovative tractor introduces the Utility Electric, a new class of products targeted at improving field operations efficiency. The T4 Electric Power fulfils New Holland's steadfast promise to assist clients in creating more sustainable agriculture for this generation and beyond while addressing contemporary farming issues like rising total cost ownership and labour scarcity.

A new era of modern agriculture is ushered in by the game-changing innovation known as T4 Electric Power. It is a great option for field operations with less horsepower and can be used for a variety of purposes, including mixed farming, dairy, livestock, municipalities, greenhouses, and specialty crops (vegetable and orchard).

The tractor is the most recent addition to New Holland's lineup of equipment powered by alternative energy sources, which also includes the T6.180 Methane Power and the T7 Methane Power LNG (Liquified Natural Gas). It is part of the brand's strategic plan for electrification. The T4 Electric Power, outfitted with a cutting-edge lithium-ion battery pack, ensures a completely new driving experience and flawless operation during loader work cycle and everyday farm routines by delivering gradual power and continuous torque at the lowest speeds.

August 2023

Six models from VST Tillers Tractors Limited's Series 9 lineup of small tractors were introduced. The 4WD compact tractor segment will include the Series 9 range of compact tractors with 18 HP and above. These are created and designed at the business's Hosur facility.