-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- CONSUMPTION & NET TRADE APPROACH

-

DATA FORECASTING

- DATA FORECASTING TECHNIQUE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

MARKET TRENDS AND GROWTH AFFECTING FACTORS

-

DRIVERS

- RISING DEMAND FOR POWER RELIABILITY AND QUALITY IN CRITICAL SECTORS

- GROWING EMPHASIS ON REGULATORY COMPLIANCE AND ENERGY STANDARDS

-

RESTRAINTS

- HIGH INITIAL INVESTMENT AND BUDGET CONSTRAINTS

- COMPLEXITY OF INTEGRATION WITH OLD INFRASTRUCTURE

-

OPPORTUNITY

- GRID MODERNIZATION AND SMART INFRASTRUCTURE DEVELOPMENT

- INTEGRATION OF RENEWABLE ENERGY AND DISTRIBUTED ENERGY RESOURCES (DERS)

-

IMPACT ANALYSIS OF RUSSIA UKRAINE WAR

-

IMPACT ANALYSIS OF TRUMP 2.0

-

COVID 19 IMPACT ANALYSIS

- MARKET IMPACT ANALYSIS

- REGIONAL IMPACT

- OPPORTUNITY AND THREAT

-

MARKET FACTOR ANALYSIS

-

SUPPLY CHAIN ANALYSIS

- COMPONENTS

- MANUFACTURERS

- DISTRIBUTORS

- END-USERS

-

PORTER’S FIVE FORCES MODEL

- BARGAINING POWER OF SUPPLIERS (LOW TO MODERATE)

- BARGAINING POWER OF BUYERS (MODERATE)

- THREAT OF NEW ENTRANTS (MODERATE)

- THREAT OF SUBSTITUTES (LOW TO MODERATE)

- INTENSITY OF RIVALRY (HIGH)

-

TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS

- INTEGRATION OF IOT (INTERNET OF THINGS) IN POWER MONITORING

- ARTIFICIAL INTELLIGENCE IN POWER SYSTEM MONITORING

- ADVANCED CYBERSECURITY FOR ENERGY DATA

-

R&D UPDATE

- CURRENT SCENARIO

- FUTURE ROADMAP

- CHALLENGES

- NOVEL APPLICATIONS

- KEY DEVELOPMENTS

-

PESTEL ANALYSIS

-

Power Monitoring System Market, BY APPLICATION

-

INTRODUCTION

-

ENERGY MANAGEMENT

-

INDUSTRIAL AUTOMATION

-

BUILDING AUTOMATION

-

TRANSPORTATION

-

Power Monitoring System Market, BY COMPONENT

-

INTRODUCTION

-

SOFTWARE

-

HARDWARE

-

SERVICES

-

Power Monitoring System Market, BY END USER

-

INTRODUCTION

-

UTILITIES

-

MANUFACTURING

-

COMMERCIAL

-

RESIDENTIAL

-

HEALTHCARE

-

Power Monitoring System Market, BY DEPLOYMENT TYPE

-

INTRODUCTION

-

ON-PREMISE

-

CLOUD-BASED

-

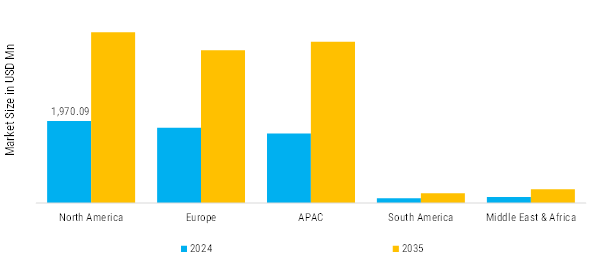

Power Monitoring System Market, BY REGION

-

INTRODUCTION

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- UK

- FRANCE

- RUSSIA

- ITALY

- SPAIN

- REST OF EUROPE

-

APAC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- MALAYSIA

- THAILAND

- INDONESIA

- REST OF APAC

-

SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

-

MEA

- GCC COUNTRIES

- SOUTH AFRICA

- REST OF MEA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

COMPETITION DASHBOARD

-

MARKET SHARE ANALYSIS, 2024

-

MAJOR GROWTH STRATEGY:

-

COMPETITIVE BENCHMARKING

-

THE LEADING PLAYER

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- ACQUISITION

- CAPACITY EXPANSION

-

COMPANY PROFILES

-

GE VERNOVA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

SIEMENS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

HITACHI ENERGY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

EATON

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

SCHNEIDER ELECTRIC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

HONEYWELL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

MITSUBISHI ELECTRIC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

FUJI ELECTRIC CO., LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

EMERSON ELECTRIC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

ROCKWELL AUTOMATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

RISHABH INSTRUMENTS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

MEGGER

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

FLUKE CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

YOKOGAWA

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

OMRON CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

DATA CITATIONS

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY REGION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COUNTRY, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY APPLICATION, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY COMPONENT, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY END USER, 2019-2035 (USD MILLION)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2019-2035 (USD MILLION)

-

COMPETITION DASHBOARD GLOBAL POWER MONITORING SYSTEM MARKET

-

THE LEADING PLAYER IN TERMS OF NUMBER OF DEVELOPMENTS IN THE GLOBAL POWER MONITORING SYSTEM MARKET

-

COMPARATIVE ANALYSIS: KEY PLAYERS FINANCIAL

-

ACQUISITION

-

CAPACITY EXPANSION

-

GE VERNOVA PRODUCTS OFFERED

-

GE VERNOVA KEY DEVELOPMENT

-

SIEMENS PRODUCTS OFFERED

-

SIEMENS: KEY DEVELOPMENTS

-

HITACHI ENERGY: PRODUCTS OFFERED

-

EATON, PRODUCTS OFFERED

-

EATON: KEY DEVELOPMENTS

-

SCHNEIDER ELECTRIC, PRODUCTS OFFERED

-

HONEYWELL: PRODUCTS OFFERED

-

HONEYWELL: KEY DEVELOPMENTS

-

MITSUBISHI ELECTRIC, PRODUCTS OFFERED

-

FUJI ELECTRIC CO., LTD. PRODUCTS OFFERED

-

EMERSON ELECTRIC., LTD.PRODUCTS OFFERED

-

ROCKWELL AUTOMATION, PRODUCTS OFFERED

-

RISHABH INSTRUMENTS, PRODUCTS OFFERED

-

MEGGER, PRODUCTS OFFERED

-

FLUKE CORPORATION, PRODUCTS OFFERED

-

YOKOGAWA, PRODUCTS OFFERED

-

OMRON CORPORATION, PRODUCTS OFFERED

-

LIST OF FIGURES

-

GLOBAL POWER MONITORING SYSTEM MARKET REGIONAL SNAPSHOT, 2024

-

GLOBAL POWER MONITORING SYSTEM MARKET SNAPSHOT, 2024

-

GLOBAL POWER MONITORING SYSTEM MARKET: STRUCTURE

-

GLOBAL POWER MONITORING SYSTEM MARKET: MARKET GROWTH FACTOR ANALYSIS (2025-2035)

-

KEY GLOBAL GROWTH RATES AND THE SHARE OF ENERGY DEMAND GROWTH BY SOURCE, 2024

-

SUPPLY CHAIN ANALYSIS: GLOBAL POWER MONITORING SYSTEM MARKET

-

PORTER’S FIVE FORCES MODEL: GLOBAL POWER MONITORING SYSTEM MARKET

-

PESTEL ANALYSIS: GLOBAL POWER MONITORING SYSTEM MARKET

-

Power Monitoring System Market, BY APPLICATION, 2024 (% SHARE)

-

Power Monitoring System Market, BY COMPONENT, 2024 (% SHARE)

-

Power Monitoring System Market, BY END USER, 2024 (% SHARE)

-

Power Monitoring System Market, BY DEPLOYMENT TYPE, 2024 (% SHARE)

-

Power Monitoring System Market, BY REGION, 2024 (% SHARE)

-

GLOBAL POWER MONITORING SYSTEM MARKET MAJOR PLAYERS MARKET SHARE ANALYSIS, 2024 (%)

-

Global Power Monitoring System Market COMPETITIVE BENCHMARKING

-

GE VERNOVA FINANCIAL OVERVIEW

-

GE VERNOVA SWOT ANALYSIS

-

SIEMENS FINANCIAL OVERVIEW

-

SIEMENS, SWOT ANALYSIS

-

HITACHI ENERGY, FINANCIAL OVERVIEW

-

HITACHI ENERGY: SWOT ANALYSIS

-

EATON, FINANCIAL OVERVIEW

-

EATON, SWOT ANALYSIS

-

SCHNEIDER ELECTRIC, FINANCIAL OVERVIEW

-

SCHNEIDER ELECTRIC.: SWOT ANALYSIS

-

HONEYWELL FINANCIAL OVERVIEW

-

HONEYWELL, SWOT ANALYSIS

-

MITSUBISHI ELECTRIC, FINANCIAL OVERVIEW

-

MITSUBISHI ELECTRIC, SWOT ANALYSIS

-

FUJI ELECTRIC CO., LTD..: FINANCIAL OVERVIEW

-

FUJI ELECTRIC CO., LTD..: SWOT ANALYSIS

-

EMERSON ELECTRIC. FINANCIAL OVERVIEW

-

EMERSON ELECTRIC. SWOT ANALYSIS

-

ROCKWELL AUTOMATION, FINANCIAL OVERVIEW

-

ROCKWELL AUTOMATION, SWOT ANALYSIS

-

RISHABH INSTRUMENTS.: FINANCIAL OVERVIEW

-

RISHABH INSTRUMENTS.: SWOT ANALYSIS

-

MEGGER, SWOT ANALYSIS

-

FLUKE CORPORATION.: SWOT ANALYSIS

-

YOKOGAWA.: FINANCIAL OVERVIEW

-

YOKOGAWA.: SWOT ANALYSIS

-

OMRON CORPORATION.: FINANCIAL OVERVIEW

-

OMRON CORPORATION.: SWOT ANALYSIS

Leave a Comment