Emergence of New Poultry Diseases

The emergence of new and re-emerging poultry diseases is a significant factor influencing the Poultry Vaccines Market. Diseases such as avian influenza and Newcastle disease pose substantial threats to poultry health and production. The World Organization for Animal Health has reported increased incidences of these diseases, prompting a need for effective vaccination solutions. As outbreaks can lead to severe economic losses, poultry producers are compelled to adopt comprehensive vaccination programs. This trend is likely to drive innovation in vaccine development, as companies strive to create more effective and targeted vaccines. The Poultry Vaccines Market is thus positioned for growth as the need for disease prevention becomes increasingly critical.

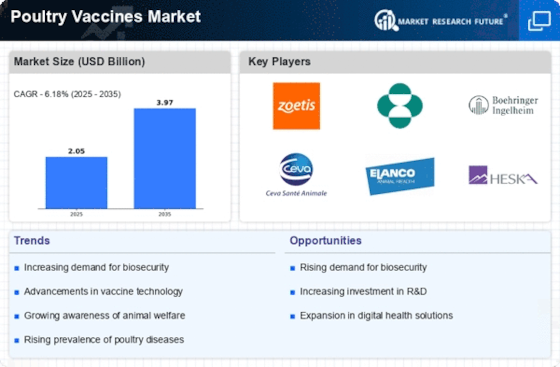

Advancements in Vaccine Technology

Technological advancements in vaccine development are reshaping the Poultry Vaccines Market. Innovations such as recombinant vaccines and vector-based vaccines are enhancing efficacy and safety profiles. These advancements allow for more targeted immunization strategies, reducing the need for multiple vaccinations. Furthermore, the integration of biotechnology in vaccine production is streamlining processes and improving accessibility. As producers seek to optimize flock health and reduce costs, the adoption of these advanced vaccines is likely to increase. The Poultry Vaccines Market stands to benefit from these technological improvements, as they align with the industry's goals of efficiency and sustainability.

Rising Demand for Poultry Products

The increasing The Poultry Vaccines Industry. As populations grow and dietary preferences shift towards protein-rich foods, poultry remains a staple. According to recent data, poultry consumption is projected to rise by approximately 2.5% annually, leading to heightened production needs. This surge in demand necessitates effective vaccination strategies to ensure healthy flocks and minimize disease outbreaks. Consequently, poultry producers are investing in vaccines to enhance productivity and maintain supply chains. The Poultry Vaccines Market is thus experiencing growth as producers seek to safeguard their investments and meet consumer expectations.

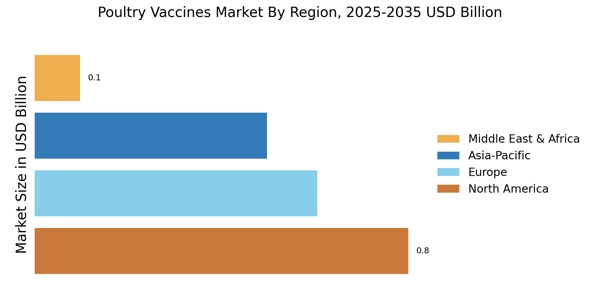

Increased Investment in Animal Health

The growing recognition of animal health's role in food security is driving increased investment in the Poultry Vaccines Market. Governments and private sectors are allocating more resources to enhance poultry health and disease prevention measures. This trend is evident in various regions, where funding for veterinary services and vaccine research is on the rise. For instance, initiatives aimed at improving biosecurity and vaccination coverage are being implemented to mitigate disease risks. As investments in animal health continue to grow, the Poultry Vaccines Market is likely to expand, providing opportunities for innovation and improved health outcomes for poultry.

Regulatory Support for Vaccination Programs

Regulatory support for vaccination programs is a crucial driver of the Poultry Vaccines Market. Governments are increasingly recognizing the importance of vaccination in maintaining poultry health and preventing disease outbreaks. Policies that promote vaccination initiatives and provide guidelines for vaccine use are being established. This regulatory framework not only encourages poultry producers to adopt vaccination practices but also fosters research and development in the vaccine sector. As compliance with these regulations becomes essential for market access, the Poultry Vaccines Market is expected to grow, driven by the need for effective vaccination strategies that align with regulatory standards.