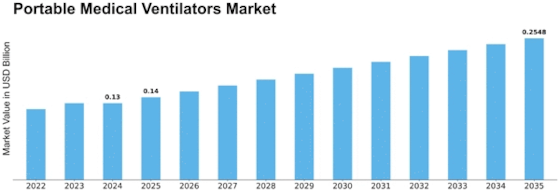

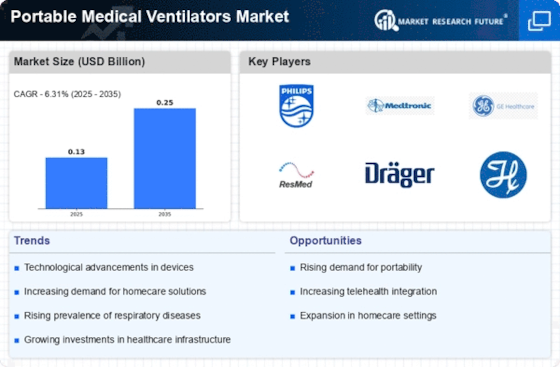

Portable Medical Ventilators Size

Portable Medical Ventilators Market Growth Projections and Opportunities

The Portable medical ventilators market is substantially motivated by global health emergencies, together with pandemics and herbal screw-ups. The demand for transportable ventilators surges at some stages of health crises. At the same time, there is a want for rapid deployment of respiratory guides in various healthcare settings, impacting the market boom. The rising occurrence of respiration diseases, including chronic obstructive pulmonary disease (COPD) and pneumonia, contributes to the demand for portable medical ventilators. These devices are crucial for imparting respiration help to sufferers with compromised lung function, using market growth. Demographic trends, especially the growing older populace, play an essential role in the market dynamics. Elderly individuals often revel in respiratory troubles, and the portability of ventilators becomes vital for imparting respiratory assistance in both home care and healthcare facilities. The want for crucial care transport in emergency medical services and ambulances fuels the demand for transportable ventilators. These gadgets are designed to be compact and suitable for transport, ensuring that sufferers get hold of the ventilatory guide during transit to healthcare facilities, impacting market growth. Government investments in healthcare infrastructure, mainly in rising economies, make contributions to the market for portable medical ventilators. Efforts to decorate healthcare abilities, including the provision of breathing assist gadgets, pressure the adoption of transportable ventilators in numerous regions. Preparedness for pandemics and the creation of strategic ventilator stockpiles by means of governments and healthcare agencies influence market dynamics. The emphasis on having an adequate supply of portable medical ventilators for emergencies contributes to market increase. The choice to beautify patient mobility and independence is a market component. Portable medical ventilators permit sufferers with respiratory situations to preserve a certain stage of mobility and participate in daily activities, influencing the adoption of these devices. The integration of telemedicine and remote-affected person tracking practices influences the market. Portable ventilators with connectivity functions allow remote monitoring of sufferers' respiration status, aligning with the trend of telehealth and influencing market adoption. Global collaboration in healthcare, mainly during health crises, influences the provision and distribution of portable medical ventilators. Collaborative efforts between countries and international agencies have an effect on market accessibility and deal with the demand for ventilators in areas with pressing healthcare desires. The resilience of the delivery chain and production capacities for transportable ventilators becomes critical in the course of instances of multiplied demand.

Leave a Comment