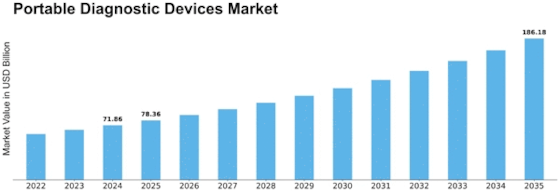

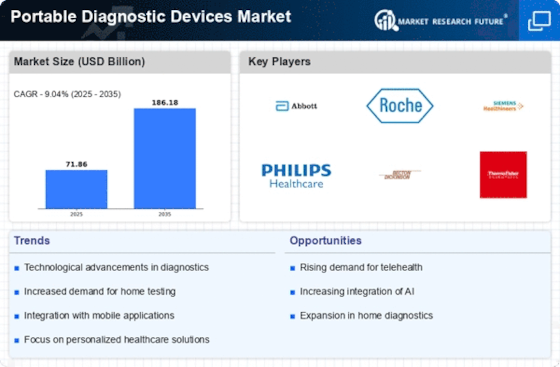

Portable Diagnostic Devices Size

Portable Diagnostic Devices Market Growth Projections and Opportunities

Increased point-of-care diagnostic will impact portable diagnostic equipment sales. Healthcare workers and patients are embracing portable diagnostic devices for rapid examinations. These devices save time and effort in lab diagnostic . Technology continuously impacts the microscopic diagnostic equipment business. Better connections, sensors, and smaller diagnostic equipment are driving the industry. These developments have made portable diagnostic equipment more accurate and helpful, therefore doctors are interested in them. Globally rising chronic illnesses including diabetes, heart disease, and infectious diseases drive the market. Chronic illness monitoring and management are easier with portable diagnostic instruments, helping patients regain control. Condensed diagnostic tools are required more than ever owing to the trend above. Healthcare professionals and people are realizing the advantages of early detection and monitoring, making portable diagnostic devices more popular. Improvements to healthcare facilities, particularly in developing countries, enhance the business. It expands public access to these devices. Market shift toward private healthcare is significant. Portable health diagnostic gadgets reduce hospital visits by letting people check their health at home. The patient-centered care movement widens the market and enhances patient experience. Market orientation is based on portable diagnostic equipment's time and money savings. These devices may replace conventional diagnostic methods without costing much, making them appealing in low-resource settings. Small technologies let physicians make judgments swiftly with their outcomes. Business-friendly government policies influence portable diagnostic equipment. These devices are made and utilized owing to financial incentives, public-private collaborations, and laws. These efforts grow markets. As global health issues like COVID-19 grow, rapid and compact diagnostics are crucial. Portable diagnostic technology research and investment are motivated by the need for rapid, convenient diagnostic services. Over time, this tendency will impact the market. Partnerships between corporations and educational institutions and between important market participants disseminate new ideas and grow the market. These initiatives improve portable diagnostic equipment and accessibility. Competition is accelerating the development of portable diagnostic devices. Businesses provide accuracy, user-friendliness, and several connectivity possibilities to stand out. Competition promotes innovation and provides clients with several high-quality portable diagnostic choices.

Leave a Comment