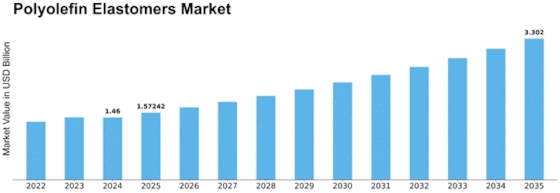

Polyolefin Elastomers Size

Polyolefin Elastomers Market Growth Projections and Opportunities

Numerous variables interact to shape the dynamics of the Polyolefin Elastomers (POE) market. It is imperative for industry players seeking to navigate and leverage chances in the Polyolefin Elastomers sector to comprehend these market variables. Here is a brief synopsis presented in the style of a paragraph with a pointer structure: Availability of Raw Materials: The price and availability of raw materials have a big impact on the market for polyolefin elastomers. Since POE is a derivative of polyethylene, its entire cost structure is impacted by changes in the production and pricing patterns of ethylene and other important feedstocks. Industries of End Users: POE is widely used in a variety of end-user sectors, including packaging, footwear, and automobiles. shifts in these industries' demand brought about by the state of the economy and customer preferences, and industry-specific trends, directly impact the overall consumption of Polyolefin Elastomers. Technological developments: Continuous developments in formulation and polymer processing techniques have a major influence on the POE industry. The market for polyolefin elastomers is expanding as a result of new applications being developed, product performance enhancements, and production process innovations. Environmental regulations: Tight environmental regulations and a rising awareness of sustainability are driving the demand for environmentally friendly products. Due to their flexibility and reusability, polyolefin elastomers stand to benefit from increased focus on environmentally friendly alternatives in a number of industries. Global Economic Conditions: The overall status of the world economy has a major impact on the demand for polyolefin elastomers. Economic fluctuations, including recessions and booms, can affect consumer spending and industry production in the long run.

Leave a Comment