Market Analysis

In-depth Analysis of Polyolefin Battery Separator Films Market Industry Landscape

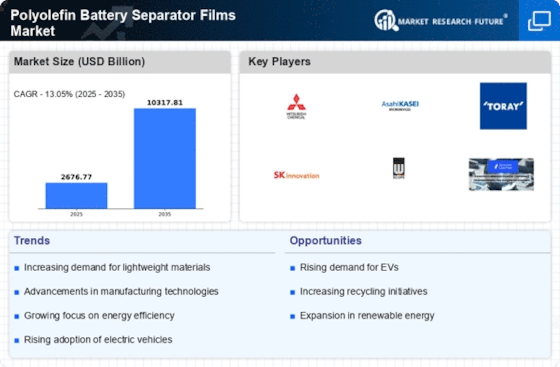

The dynamics of the PBSF market have been shaped by surging demands for advanced energy storage solutions, leading to an increased focus on polymer materials like polyolefin as major components of battery separators due to their characteristics, such as excellent chemical resistance and high thermal stability, among others. The rapid growth of the electric vehicle market has caused immense interest in the PBSF sector. With the automotive industry undergoing transformational change towards electrification due to the increasing need for high-performance batteries used in EVs, these films play crucial roles in enhancements of lithium-ion batteries' safety precautions besides improving their effectiveness overall. Being lightweight, together with having excellent mechanical strength, makes them better options when it comes to the durability and performance of battery systems in EVs. Moreover, the market dynamics of PBSF are further shaped by the booming consumer electronics industry. The widespread use of smartphones, tablets, and wearables calls for batteries that are compact and light and have a higher energy density. Thin yet effective barriers between positive and negative electrodes in batteries, such as Polyolefin Battery Separator Films, help meet these demands. Besides that, there have been continuing improvements in battery technology that have affected the dynamics of the sector. Consequently, demand for polyolefin battery separator films is expected to rise due to the development of batteries with higher energy densities, increased life span, and improved safety features by researchers and manufacturers. This material is compatible with any battery chemistry while being able to tolerate harsh operating conditions, thus making it suitable for next-generation batteries. The PBSF market on the supply side is characterized by a competitive landscape with several key market players fighting for their market share. For this reason, firms are concentrating on research and development initiatives to come up with advanced polyolefin formulations that satisfy specific application requirements. Nonetheless, these factors, among them fluctuations in raw material prices, may hinder market growth or even pose potential threats to it, as well as environmental concerns relating to polymer production. Therefore, stakeholders must understand that sustainable practices and the invention of eco-friendly polyolefin formulations are important aspects of business success due to the need for compliance with regulatory pressures and addressing environmental concerns accordingly.

Leave a Comment