Market Analysis

In-depth Analysis of Polymeric Surfactants Market Industry Landscape

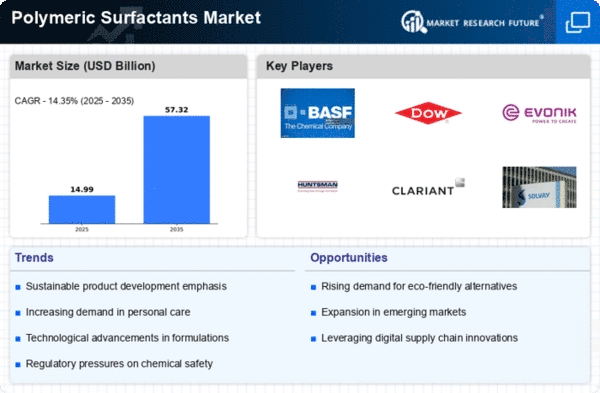

Polymeric surfactants are a key chemical industry segment, and their production, demand, and market trends are shown by their market dynamics. Polymeric surfactants, used in personal care, agriculture, and oil and gas, are stable and effective due to their varied surface-active characteristics. Technological advances drive formulation and application breakthroughs in the polymeric surfactants market. Manufacturers invest in R&D to keep ahead of technology developments and offer high-quality products for many industries.

Polymeric surfactants are heavily influenced by global supply and demand. Domestic and international economic dynamics drive product demand across sectors. Economic expansion boosts polymeric surfactant use in various applications, while downturns limit industrial activity. The market affects investment, production, and pricing, as well as the global economy.

The polymeric surfactants industry is increasingly influenced by environmental factors. Sustainability and eco-friendliness are driving demand for surfactants with low environmental effect. Pressure is on manufacturers to use greener production processes and biodegradable polymeric surfactants. In an environmentally sensitive market, polymeric surfactant companies that promote sustainability may have an advantage.

Due to their many uses, polymeric surfactants are very competitive. Manufacturers must differentiate through quality, cost-effectiveness, and innovation. Differentiation tactics like creating polymeric surfactant compositions for specific applications or improving performance are vital to market share. Companies must continuously research and develop to stay ahead of the competition and suit client needs.

Trade policies and geopolitics affect polymeric surfactant markets. Tariffs, import/export rules, and geopolitical conflicts can affect polymeric surfactant availability and pricing worldwide. Manufacturers must monitor trade policies and geopolitics to alter their strategy and reduce global market risks.

Standards and regulations shape the polymeric surfactants market. Compliance with safety, quality, and environmental standards is essential for market acceptance. Proactively addressing regulatory issues helps polymeric surfactant companies retain marketability and good connections with customers and regulators.

Consumer choices and market trends affect polymeric surfactants market dynamics. Consumer preferences for polymeric surfactants can change due to sustainability, safety, and industrial practices. These developments require manufacturers to adapt their products to changing consumer expectations and market trends.

Leave a Comment