Polymer Foam Size

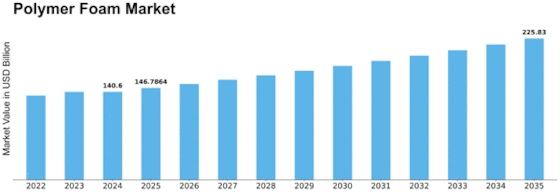

Polymer Foam Market Growth Projections and Opportunities

The polymer foam market is influenced by various market factors that shape its growth and dynamics. One of the primary factors driving the polymer foam market is the increasing demand from end-use industries such as construction, automotive, packaging, and furniture. These industries use polymer foams extensively due to their lightweight nature, insulation properties, and cost-effectiveness. As urbanization and industrialization continue to rise globally, the demand for polymer foams in construction for insulation purposes is expected to grow significantly.

Polymer foams are having superior properties like excellent strength to weight ratio, lightweight, good energy absorbance and also provides comfort due to their softness and flexibility. It also has acoustic & insulation capabilities, and fire resistance property makes them applicable for manufacturing insulation panels and flooring products. Plastic foams are produced by the matrix of air bubbles with the help of a blowing agent in the polymer base. These foams are produced using various techniques like injection molding, blow molding, extrusion, and slab stock by pouring.

Moreover, the automotive industry is a major consumer of polymer foams for applications such as seating, interior components, and insulation. With the growing trend towards lightweight vehicles to improve fuel efficiency, polymer foams are preferred over traditional materials like metal and glass. Additionally, stringent regulations pertaining to vehicle emissions and safety standards are driving the adoption of polymer foams in automotive manufacturing.

Another significant market factor is technological advancements and innovations in polymer foam manufacturing processes. Manufacturers are investing in research and development to enhance the properties of polymer foams, making them more durable, lightweight, and environmentally friendly. Advancements in chemical formulations and manufacturing techniques have led to the development of bio-based and recyclable polymer foams, which are gaining traction in the market due to their sustainability credentials.

Furthermore, the economic landscape and consumer preferences play a crucial role in shaping the polymer foam market. Economic stability and growth contribute to increased investments in infrastructure projects, automotive production, and consumer goods manufacturing, thereby driving the demand for polymer foams. Additionally, changing consumer preferences towards sustainable and eco-friendly products are prompting manufacturers to develop environmentally responsible polymer foams to cater to the growing demand from eco-conscious consumers.

The availability and cost of raw materials are also key market factors that impact the polymer foam industry. Raw materials such as polyethylene, polypropylene, polystyrene, and polyurethane are essential for the production of polymer foams. Fluctuations in raw material prices, supply chain disruptions, and geopolitical factors can affect the overall production costs and profitability of polymer foam manufacturers. Therefore, securing a stable supply of raw materials and implementing effective supply chain management strategies are essential for the success of companies operating in the polymer foam market.

Moreover, regulatory policies and environmental regulations imposed by governments and regulatory bodies have a significant influence on the polymer foam market. Stringent regulations aimed at reducing carbon emissions, promoting energy efficiency, and minimizing environmental impact are driving the adoption of sustainable and recyclable polymer foams. Manufacturers are required to comply with these regulations and invest in eco-friendly production processes to ensure compliance and maintain a competitive edge in the market.

Leave a Comment