Top Industry Leaders in the Polyisobutylene Market

Polyisobutylene (PIB), a versatile synthetic rubber, finds its way into everything from tires and chewing gum to lubricants and adhesives. Understanding the competitive landscape of this ever-evolving market is crucial for players seeking to thrive.

Strategies Advancing Market share:

-

Product Diversification: Leading PIB producers like ExxonMobil and BASF are strategically expanding their product portfolios. BASF, for instance, recently introduced its Butaver® range of high-performance PIBs catering to specific end-use applications. -

Geographical Expansion: Targeting high-growth markets like Asia Pacific is a key strategy. Companies like TPC Group are investing in production facilities in China and India to capitalize on the region's booming demand for PIB in segments like automotive and lubricants. -

Partnerships and Acquisitions: Collaborations and acquisitions are fostering innovation and market consolidation. The Lubrizol Corporation's acquisition of Carylon in 2023 strengthened its position in the PIB lubricants market. -

Sustainability Initiatives: Addressing environmental concerns through eco-friendly PIB production processes is gaining traction. Braskem, a major PIB producer, launched its Green PIB line using renewable feedstock, appealing to sustainability-conscious consumers.

Factors Shaping Market Share:

-

Application Diversification: The use of PIB in diverse applications like food packaging and pharmaceuticals offers vast growth potential. Companies are actively developing specialty PIB grades tailored to these emerging segments. -

Technological Advancements: Innovations like high-molecular-weight PIB with superior properties are creating new opportunities. These advancements lead to lighter and more fuel-efficient automotive components, driving demand in the transportation sector. -

Regional Demand Variations: Asia Pacific remains the largest PIB market due to its rapidly growing automotive and industrial sectors. However, Europe and North America are witnessing a shift towards higher-value applications like medical devices, influencing product development strategies. -

Fluctuating Raw Material Prices: The price volatility of Isobutylene, the primary feedstock for PIB, can impact production costs and market dynamics. Companies are exploring alternative feedstocks to mitigate this risk.

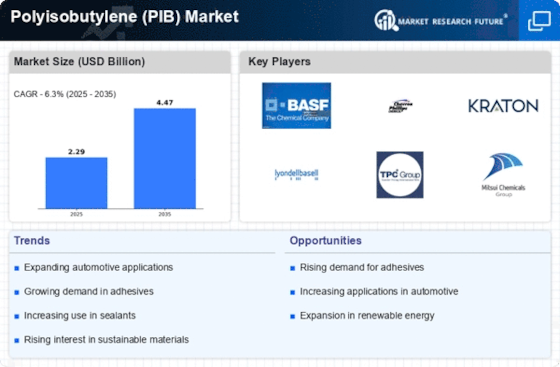

Key Companies in the Polyisobutylene (PIB) market include

- LANXESS (Germany)

- Exxon Mobil Corporation (U.S.)

- BASF SE (U.S.)

- Lubrizol Corporation (U.S.),

- DAELIM (South Korea)

- Chevron Oronite Company LLC (U.S.)

- TPC Group (U.S.)

- INEOS (UK)

- JXTG Nippon Oil & Energy Corporation (Japan)

Recent Developments:

September 2023: ChemAnalyst reported a decline in Polyisobutylene prices in the US and Asia-Pacific regions due to decreased automotive industry demand and lower freight charges.

October 2023: The increasing use of Polyisobutylene in electric vehicle tires was highlighted as a significant driver for market growth, due to its low rolling resistance and extended lifespan.

November 2023: Kraton Corporation launches new line of PIB-based adhesives and sealants: These products are designed for the automotive and construction industries and offer superior performance and durability.