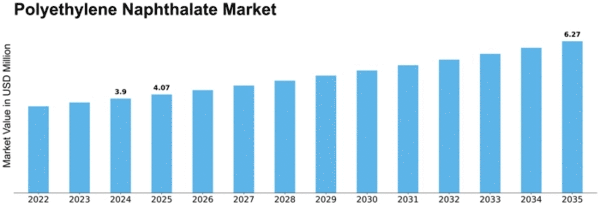

Polyethylene Naphthalate Size

Polyethylene Naphthalate Market Growth Projections and Opportunities

The Polyethylene Naphthalate (PEN) market is influenced by a variety of factors that shape its dynamics and growth trajectory. One of the key market factors is the demand from end-use industries such as packaging, electronics, automotive, and textiles. These industries utilize PEN for its excellent mechanical properties, thermal stability, and chemical resistance, making it suitable for a wide range of applications.

Global Polyethylene Naphthalate Market is primarily driven by the increasing use of polyethylene naphthalate in packaging applications to improve the thermal and barrier properties. The increasing use of polyethylene naphthalate in food packaging is expected to propel the market growth during the review period due to its high durability and resistance to chemicals and solvents.

Another significant market factor is the availability and price of raw materials used in the production of PEN. Naphthalene and ethylene glycol are the primary raw materials for PEN manufacturing, and fluctuations in their prices can impact the overall production costs and pricing of PEN products. Additionally, the availability of technology for PEN production and processing also plays a crucial role in determining market competitiveness and growth potential.

Market regulations and environmental policies also influence the PEN market dynamics. Regulations related to packaging materials, recycling initiatives, and environmental sustainability can drive the adoption of PEN as a viable alternative to traditional plastics. Furthermore, consumer preferences for eco-friendly and sustainable products can create opportunities for PEN manufacturers to cater to this demand and differentiate their offerings in the market.

Global economic conditions and geopolitical factors also have a significant impact on the PEN market. Economic growth, trade policies, currency exchange rates, and geopolitical tensions can affect the overall demand for PEN products and the investment climate for PEN manufacturers. For example, a slowdown in economic growth may lead to reduced demand for PEN products in key markets, while trade disputes or tariffs could disrupt supply chains and market dynamics.

Technological advancements and innovations in PEN manufacturing processes also shape the market landscape. Continuous research and development efforts aimed at improving PEN properties, reducing production costs, and enhancing process efficiency contribute to market growth and competitiveness. Additionally, innovations in downstream applications and product development open up new opportunities for PEN manufacturers to expand their market presence and capture additional market share.

Competitive factors such as market concentration, industry consolidation, and competitive strategies adopted by key players also influence the PEN market dynamics. The presence of large multinational corporations, as well as small and medium-sized enterprises, creates a competitive environment where companies compete based on factors such as product quality, pricing, branding, and distribution channels. Mergers, acquisitions, partnerships, and strategic alliances are common in the PEN industry as companies seek to strengthen their market position and gain a competitive edge.

Lastly, consumer trends and preferences play a crucial role in shaping the PEN market. Changing lifestyles, evolving consumer preferences, and increasing awareness about environmental issues drive demand for sustainable and environmentally friendly products. As consumers become more conscious of the environmental impact of their purchasing decisions, there is a growing demand for products made from recyclable materials such as PEN. Therefore, understanding consumer trends and preferences is essential for PEN manufacturers to develop products that resonate with target customers and gain a competitive advantage in the market.

Leave a Comment